ETFB Sri Lanka Contributions Payment : Employees Trust Fund Board

Organisation : Employees Trust Fund Board

Facility Name : Payment of Contributions

Applicable Country : Sri Lanka

Website : https://etfb.lk/payment-of-contributions/

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Pay ETFB Sri Lanka Contributions?

Employers Divided into Two categories

** Larger Category > Employers who are having 15 or more employees.

** Smaller Category > Employers who are having less than 15 employees.

Related / Similar Facility : ETFB Sri Lanka ETF Balances Online & Via SMS

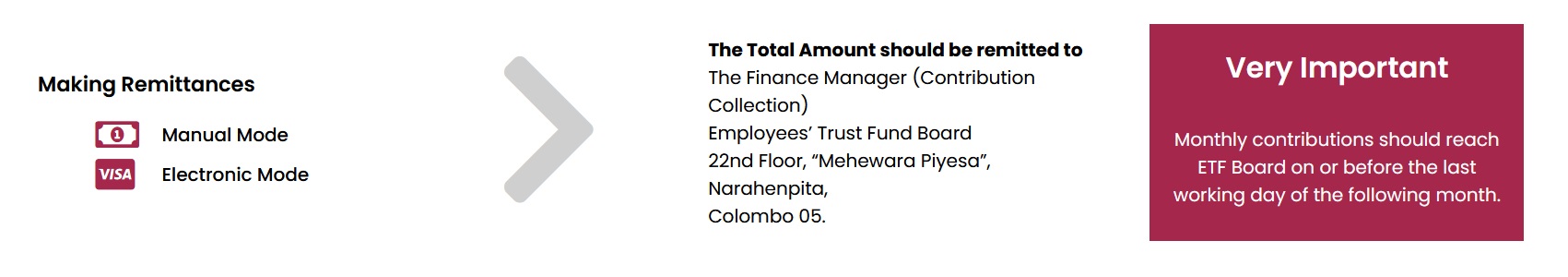

Manual Mode Payments By Cheques/Money Orders/Cash

** All payments should be made along with a duly filled Advice of Remittance ( R1 or R4 Form ) in duplicate. The duplicate copy of the form would be returned to the Employer by the ETF Boardin acknowledgement of the remittance.

** All cheques/Bank drafts must be crossed and payable to “Employees’ Trust Fund Board”. Payments by money Orders should be made favoring “Employees’ Trust Fund Board”. Paying office to be indicated as “General Post Office”.

** Payments by cheques& money orders may be made to the ETF Head Office at Narahenpita,ETF office at ColomboFort and to the regional offices at Gampaha, Kandy, Matara,Kurunegala, Galle, Ratnapura, Anuradhapura, Kalutara, Hatton, Badulla, Kegalle, Hambantota & Ampara.

** Payments by cash are accepted only at Bank of Ceylon- Torrington Square branch,Bank of Ceylon – Super Grade Branch at Pettah, and People’s Bank – Narahenpita branch.

** Amount in the cheque or money order should tally with the total amount indicated in the Remittance Form.

** A separate remittance form should be used for each month in respect of payments ofarrears. If not so, please attach a separate schedule indicating the breakdown of the total amount.

** Employers who make payments with R1 Remittance Form should continue the same procedure, even though the number of employees falls below 15 in any month.

** All government and semi-government institutions should use R1 Remittance Forms to makepayments. Individual member contribution details should be sent in Form II form on half yearlybasis. For details please contact Manager – Member Accounts (Larger Category) on Telephone No. +94 11 7747259

** Employers who wish to change the Remittance Form from R4 to R1, as a result of increasing the number of employees in their establishments, should inform the ETF Office, for necessary instructions, before changing the remittance form. (Tel. +94 11 7747264)

Important:

Employers who have more than 15 employees must use the R1 Remittance Form and employers who have less than 15 employees may use the R4 Remittance Form when they make monthly contributions. For further details please contact the ETF Office on Telephone Nos. +94 11 7747260 / +94 11 7747263

ETF Contribution Payment Through Online Payment Modes

ETF Board has introduced on-line payment scheme, since it is the most convenient and quick payment system. Regulations made by the Minister of Finance, Economic Stabilization and National Policies by virtue of the powers vested in him by Section 43, of the Employees’ Trust Fund Act, No. 46 of 1980.

Employers may use following electronic payment methods :

** Online Payment

** Direct Debit

Online Payments :

This facility can be arranged through following banks:

Bank of Ceylon:

+94 11 2204659

+94 11 2204654

Commercial Bank:

+94 11 2353588

+94 11 2353628

Peoples Bank:

+94 11 2594503

+94 11 2586631

Sampath Bank:

+94 11 2332173

+94 11 4730572

Seylan Bank:

+94 11 2008888

Nations Trust Bank:

+94 11 4711411

D F C C Bank:

+94 11 2310537

+94 11 2310551

Hatton National Bank:

+94 11 2661976

+94 11 2661960

National Development Bank:

+94 76 5366381

+94 77 3402759

Direct Debit Payments:

This facility can be arranged through any Commercial Bank in Sri Lanka:

For further details and facility arrangements you may contact the following persons.

Mangala – 0117747829 2. Lahiru – 0117747850

Note:

** The file format of the magnetic media file to upload the Form II/ R4(Member details) through Internet are given in the Form II /R4 member datafile format details.

** Prior to make the payments please obtain details about uploading of member contributions from Manager (Member Accounts – Larger Category) of ETF Board on 011-2369596

** In case of surcharge payments, entering of Surcharge Notice number is mandatory.

** Please obtain a receipt from the computer as an acknowledgement. Receipts are not issued by theETF Board for payments made through Internet.