FBR e-Payment Customs Duty : Federal Board of Revenue Pakistan

Organisation Name : Federal Board of Revenue (fbr.gov.pk)

Facility Name : e-Payment Customs Duty

Location : Islamabad

Country : Pakistan

Website : https://fbr.gov.pk/e-payment/152821

| Want to comment on this post? Go to bottom of this page. |

|---|

FBR e-Payment Customs Duty

Federal Board of Revenue e-Payment Customs Duty

Related / Similar Service : FBR e-Payment for Income Tax, Sales Tax & Federal Excise Pakistan

How to Create PSID for E-Payment?

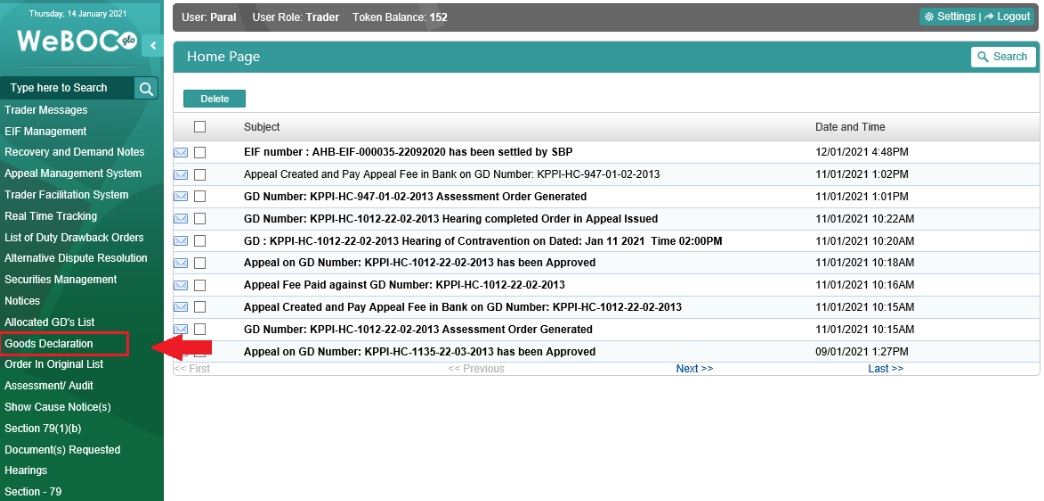

** Please login to WeBOC System using URL: https://web.archive.org/web/20120302050643/http://www.weboc.gov.pk:80/

** In order to prepare Goods Declaration, please click on Left Menu: Goods Declaration

First Payment through E-Payment

Steps :

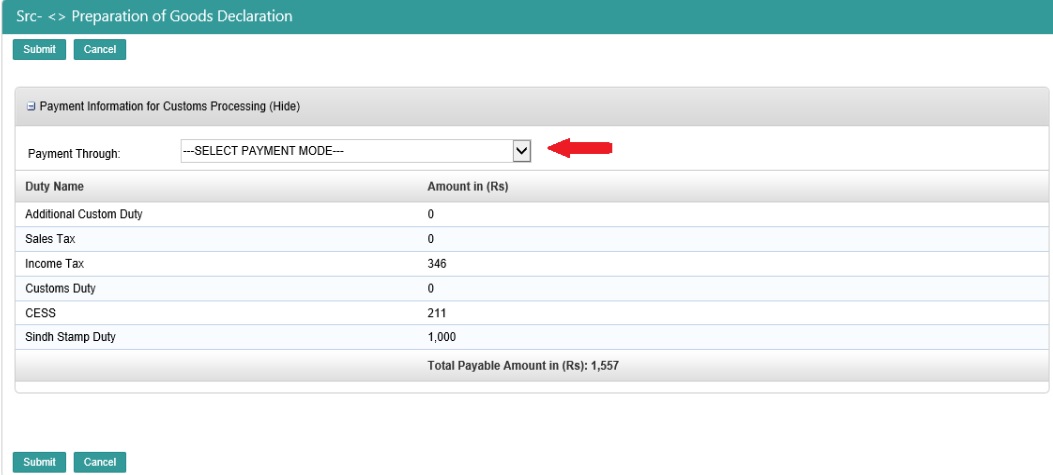

Step 1 : Upon preparation of Goods Declaration (GDs), validation of GD contents by clicking button and then click on button to check duty/tax amounts. After checking/confirmation of duty/tax amounts, click on button and following screen will appear.

Step 2 : Click on the Drop-Down-Box highlighted (red)

Step 3 : Now select E-Payment option from the Drop-Down-Box and click on button

Step 4 : Now click on the Generate PSID button

Step 5 : On pressing the Generate PSID button, your PSID creation process is complete and you will get a PSID (Payment Slip ID) number. Please do note down the PSID number as this will be required to pay through online banking/mobile banking, OTC (Over the counter payment), payment using ATM machines and other payment options which will be explained in latter part of this document.

Additional Payment through E-Payment

Steps :

Step 1 : In case of Additional Payment against your GD. Click on they ‘Payment Management’ Tab in the left side privileges menu

Step 2 : Now click on ‘Create Payment Through 1Link’ tab

Step 3 : Click on the Tick button for opening next screen

Step 4 : Now Search the Goods Declaration (GD) using Gd number or any other search criteria and Click on Tick button

Step 5 : On below screen, click on the Generate PSID button

Step 6 : On pressing the Generate PSID button, your PSID creation process is complete and you will get a PSID (Payment Slip ID) number. Please do note down the PSID number as this will be required to pay through online/mobile banking, OTC (Over the counter payment), payment using ATM machines

Guidelines : https://www.statusin.org/uploads/pdf2021/60510-Gl.pdf

Payment through Internet Banking

(Standard Chartered Interface has been used for illustration purposes.

Steps :

Step 1 : Please provide your respective details to login to internet banking

Step 2 : Select “Payments” option from left Menu

Step 3 : Select “TAX PAYMENTS” from Bill Payee Type, and “FBR/PRA” from Bill Payee Name

Step 4 : Type your PSID you want to pay in “PSID” field and press next

Step 5 : Verify the details of payment loaded and press Next to make payment

Step 6 : Agree to the terms and conditions by clicking check box and Press “Confirm”

Step 7 : Provide the OTP and Email PIN to complete your online Payment