FBR e-Payment for Income Tax, Sales Tax & Federal Excise Pakistan : Federal Board of Revenue

Organisation Name : Federal Board of Revenue (fbr.gov.pk)

Facility Name : e-Payment for Income Tax, Sales Tax & Federal Excise

Location : Islamabad

Country : Pakistan

Website : https://fbr.gov.pk/e-payment/152821

| Want to comment on this post? Go to bottom of this page. |

|---|

FBR e-Payment for Income Tax

How to create an ADC payment for Income Tax, Sales Tax or FED and pay it online through any bank.

Related / Similar Service : FBR e-Payment Customs Duty

How to Apply?

Steps :

Step 1 : Go to any browser and in URL box type https://web.archive.org/web/20210814091146/https://e.fbr.gov.pk/ and press enter

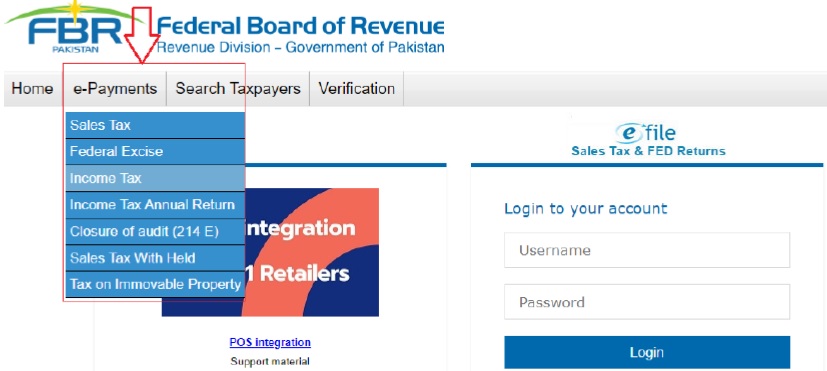

Step 2 : Go to e-Payments Menu and select the payment type

Step 3 : Click the “Income Tax” or any option from the e-Payment Menu and click

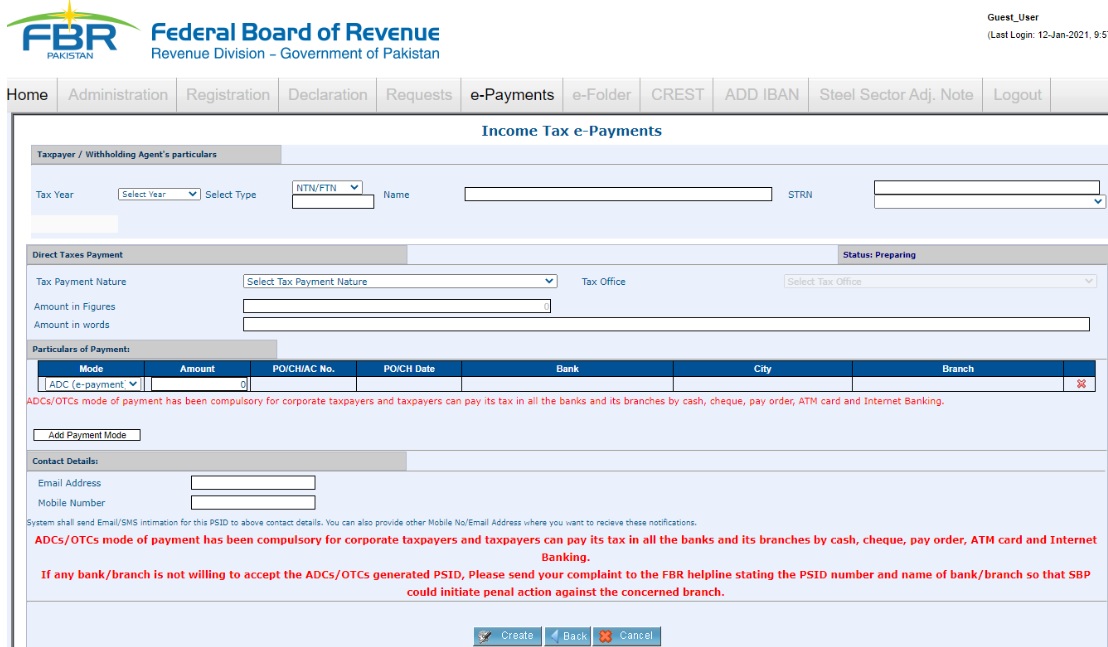

Step 4 : A new payment creation form will appear.

Step 5 : Fill this form, start by selecting the “Tax Year” From the Drop-Down list and NTN/FTN, CNIC or Reg. No. from “Select Type” Drop-Down. Once you Type NTN/FTN, CNIC or Reg. No and press “Tab” Name is automatically filled.

Step 6 : Select “Tax Payment Nature” from the Drop-Down

Step 7 : Fill rest of the Form and Select ADC (e-Payment) Option in Particular of Payments

Step 8 : Fill the complete form, make sure to provide your active and correct email address and mobile number. Now press “Create” button from the bottom of the form.

Step 9 : Read the messages/instructions printed in red color on the form, remove if it shows any error and then press “Confirm” button from bottom of the form

Step 10 : On pressing the “Confirm” button, your payment creation process is complete and you will get a PSID (Payment Slip ID) number.

Please do take print of your PSID slip and note down the PSID number as this will be required to pay through online/mobile banking, OTC (Over the counter payment) and payment using ATM machines. Please press “Print” button.

Step 11 : Now You can go to any banking online application, Mobile Banking, ATM or Visit Over the Counter of any commercial Bank branch for payment of this PSID. Following are the payment steps using standard chartered online banking.

Step 12 : Go to Bank website (Image:09) provide your respective details to login

Step 13 : Select “Payments” option from left Menu

Step 14 : Select “TAX PAYMENTS” from Bill Payee Type, and “FBR/PRA” from Bill Payee Name

Step 15 : Type your PSID you want to pay in “PSID” field

Step 16 : Verify the details of payment loaded and press Next to

Step 17 : Agree to the terms and conditions and Press “Confirm”

Step 18 : Provide the OTP and Email PIN to complete your online Payment

FAQs

1. What is PSID?

Payment Slip ID (PSID) is a 17-digit unique number generated by WeBOC system for making payment of dues by the trader through internet banking, automated teller machines (ATM), bank’s mobile applications, Over the Counter (OTC), Easy Paisa, Jazz Cash etc.

2. When is a PSID generated?

Every time a payment is created against a particular GD after selecting E-Payment option, a PSID number will be generated.

For every payment event (initial payment at the time of filing of GD and subsequent payment as a result of any reassessment) WeBOC system will generate a separate unique PSID.

3. What are the modes of E-Payment available to a We BOC user?

** Bank’s internet portal

** ATMs

** Bank Mobile bill payment application

** Over the Counter E-Payment against PSID

** Easy Paisa, Jazz Cash etc.

4. Would there be an option to view a PSID generated against a particular B/L or GD?

Yes. A user will be able to see the PSID generated against a particular B/L or GD in the sub-menu of ‘View Generated PSIDs for E-Payment’ in the ‘Payment Management’ tab.