Allowance For People Aged 60 to 64 : canada.ca

Organization : Government of Canada

Facility : Allowance For People Aged 60 to 64

Country : Canada

Website : https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/guaranteed-income-supplement/allowance.html

| Want to comment on this post? Go to bottom of this page. |

|---|

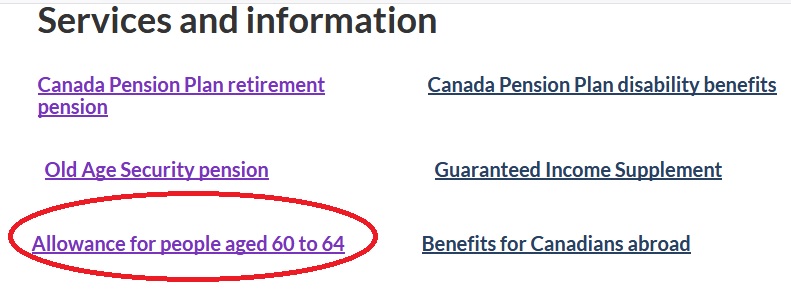

Canada Allowance For People Aged 60 to 64

The Allowance is a benefit available to low-income individuals aged 60 to 64 who are the spouse or common-law partner of a Guaranteed Income Supplement (GIS) recipient.

Related / Similar Status :

Eligibility

You qualify for the Allowance if you meet all of the following conditions :

** you are aged 60 to 64 (includes the month of your 65th birthday);

** your spouse or common-law partner receives an Old Age Security pension (OAS) and is eligible for the GIS;

** you are a Canadian citizen or a legal resident;

** you reside in Canada and have resided in Canada for at least 10 years since the age of 18; and

** you and your spouse or common-law partner’s annual combined income is less than the maximum allowable annual threshold.

Other situations where you might qualify for the Allowance :

** If you meet all the above eligibility conditions, but your spouse or common-law partner does not receive the OAS pension or the GIS because they are incarcerated.

** If you have not resided in Canada for at least 10 years since you turned 18, but you have resided or worked in a country that has a social security agreement with Canada, you may still qualify for a partial benefit.

For the list of countries with which Canada has established a social security agreement, see Lived or living outside Canada. Using your income information from your federal Income Tax and Benefit Return, we will review your entitlement for the Allowance every year.

How Much Could You Receive

The amount of the Allowance you receive depends on your marital status and your previous year’s income (or in the case of a couple, your combined income). Find out what income and deductions you must report. Consult the table of Allowance and Allowance for the Survivor amounts for current benefit rates.

Note :

As of January 1, 2017, for couples where one of you receives the Guaranteed Income Supplement (GIS) and the other person receives the Allowance, if you are forced to live apart for reasons beyond your control (such as a requirement for long-term care), you may be eligible to receive higher benefits based on your individual income, as is currently the case for couples where both spouses or partners receive the GIS.

To be eligible, you must advise Service Canada in writing by submitting the Statement – Spouses or Common-law Partners Living apart for Reasons Beyond their Control explaining your living situation, and indicating the date that you and your spouse or common-law partner were first forced to live apart.

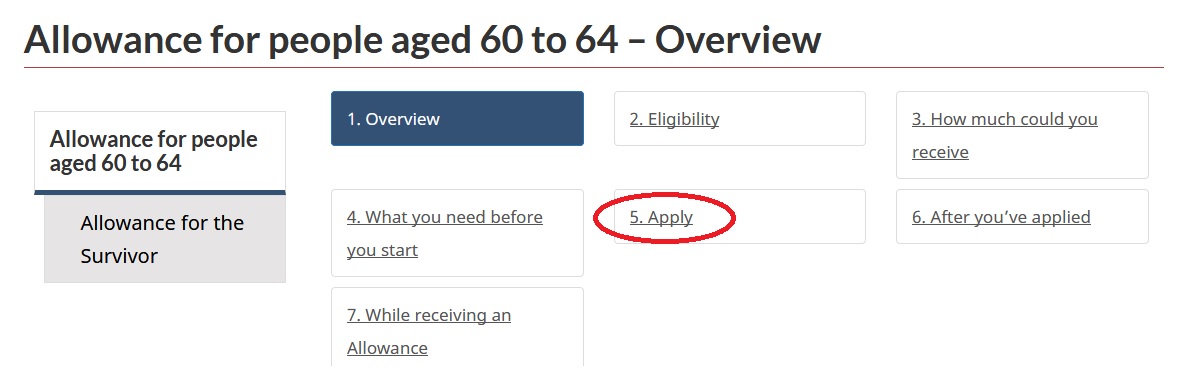

Apply

You should apply for the Allowance 6 to 11 months before your 60th birthday. You must apply in writing for the Allowance.

Complete and mail the Guaranteed Income Supplement or Statement of Income for the Allowance or Allowance for the Survivor application form (ISP-3026) for the payment year that applies to you along with the Application for the Allowance or Allowance for the Survivor form (ISP-3008) and include certified true copies of the required documentation.

Sources Of Income & Deductions

When applying for the Guaranteed Income Supplement and the Allowance, you, or in the case of a couple you and your spouse or common-law partner, must report your income and deductions.

Use the information slips issued to you for income tax purposes, as well as your federal Income Tax and Benefit Return, to report the following income and deductions :

** Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) benefits;

** other pension income, such as private pensions, superannuation and foreign pension income;

** Registered Retirement Savings Plans (RRSPs) that you cashed during the year;

** Employment Insurance benefits;

** interest and other investment income;

** capital gains and taxable Canadian dividends;

** net income from any rental properties;