tcc.firs.gov.ng Register TCC Account & Verify Receipt : Nigeria

Organization : Federal Inland Revenue Service

Facility : Register TCC Account & Verify Receipt

Country : Nigeria

Website : https://tcc.firs.gov.ng/

| Want to comment on this post? Go to bottom of this page. |

|---|

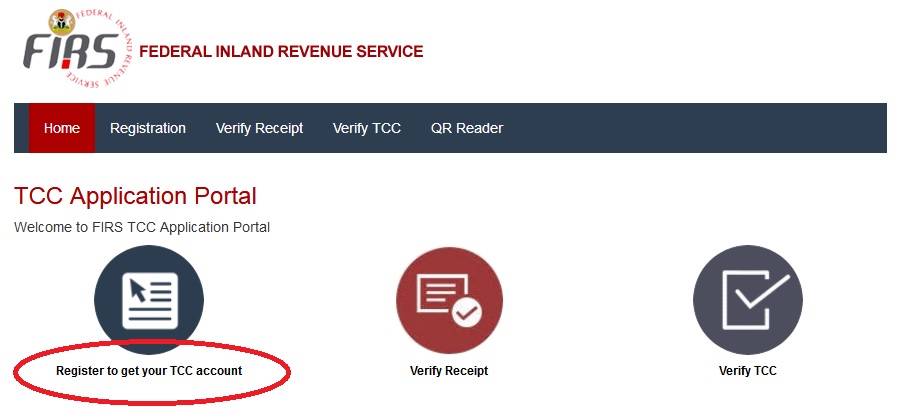

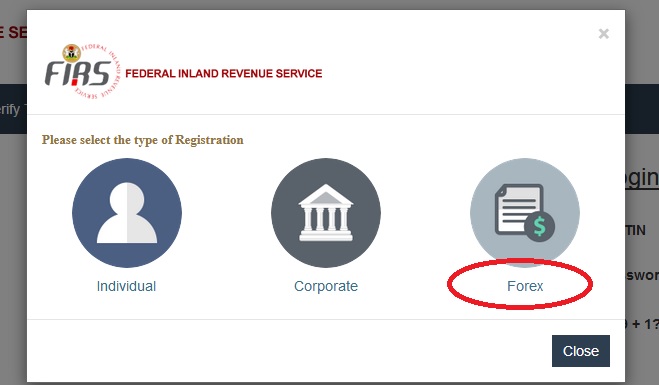

How To Register For FIRS TCC Account?

To register for FIRS TCC account, just follow the below steps

Related : Verify TCC Tax Clearance Certificate Nigeria : www.statusin.org/29481.html

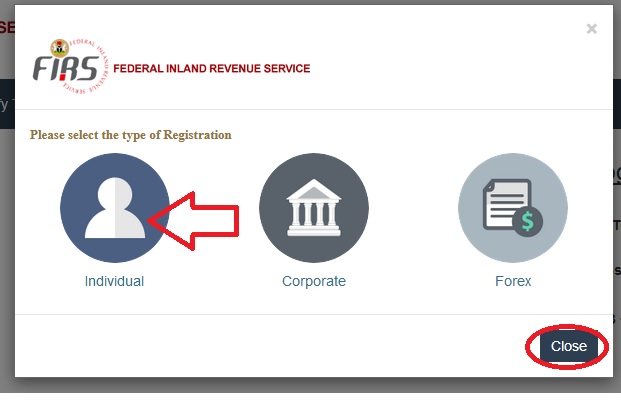

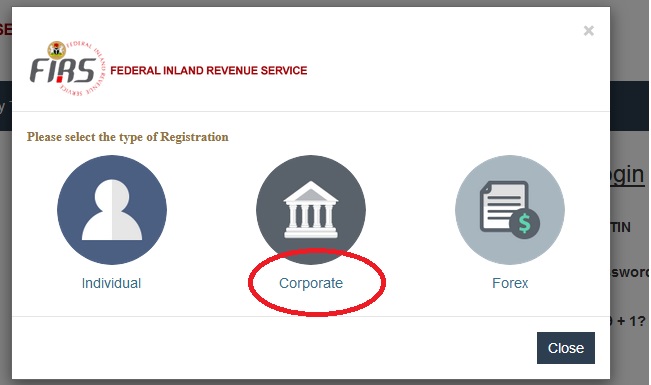

You can get your TCC by the following option,

1. Individual

2. Corporate

3. Forex

Registration for INDIVIDUAL Account :

Please enter the following details,

1. Enter Applicant Type*

2. Enter Tax Identification Number*

3. Click on Retrieve Button

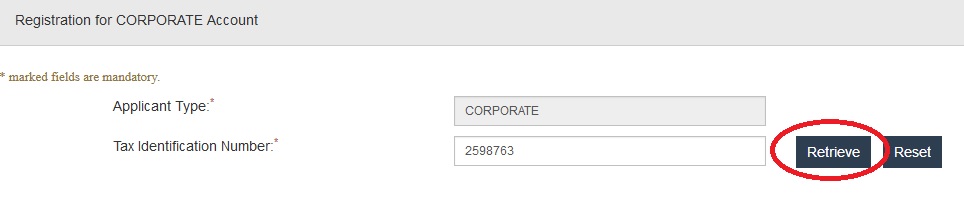

Registration for CORPORATE Account :

* marked fields are mandatory.

1. Select Applicant Type*

2. Enter Tax Identification Number*

3. Click on Retrieve Button

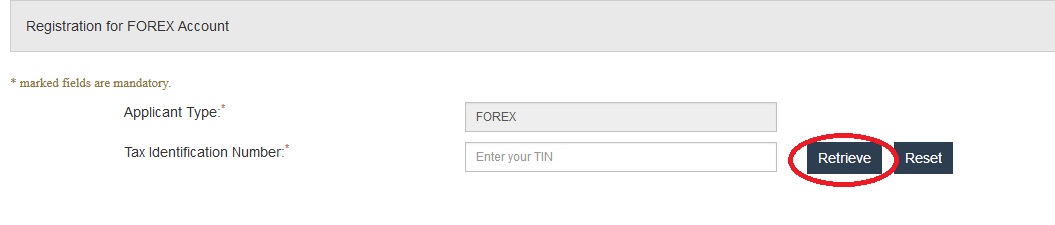

Registration for FOREX Account :

* marked fields are mandatory.

1. Select Applicant Type*

2. Enter Tax Identification Number*

3. Click on Retrieve Button

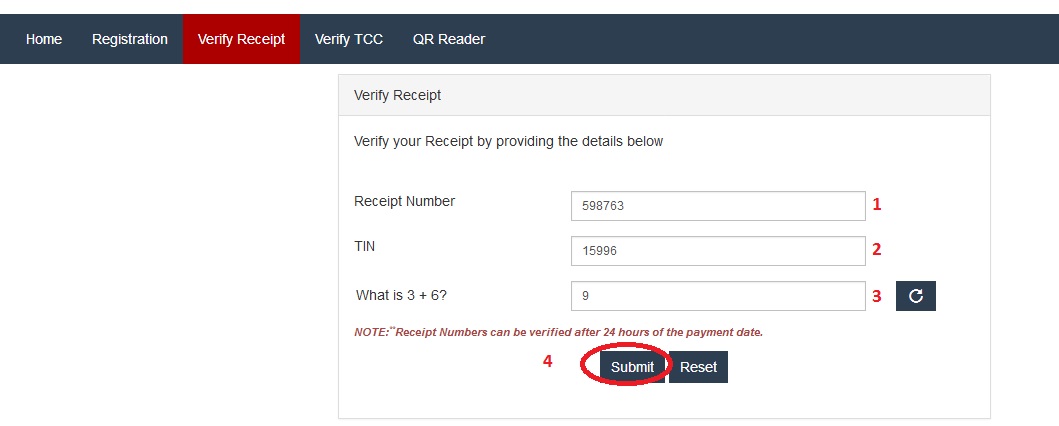

How To Verify Receipt?

Verify your Receipt by providing the details below

1. Enter Receipt Number

2. Enter TIN

3. Select Security Question eg: What is 10 + 9?

4. Click on Submit Button

FAQ On WHT/VAT

Frequently Asked Questions (FAQ) on WHT/VAT

1. What is Withholding Tax?

Withholding Tax (WHT) is an advance payment of income tax.

2. What is the Rate of Withholding Tax for companies and individuals on transactions?

There are varying rates of WHT ranging from 2.5% to 10% for companies and 5% to 10% for individuals depending on the transaction.

3. What is the due date for filing WHT returns?

On or before the 21st day of the month following the month in which the deductions were made.

4. Who are the collecting agents for WHT?

All organisations or bodies making payments to suppliers of goods and services. They are required to make deductions of Withholding Tax and remit to the Tax Authority as payments are being made to suppliers/vendors.

5. What are the relevant documents required for filing WHT returns?

i Evidence of payments such as bank teller, e-ticket, e-acknowledgement etc. from an FIRS designated revenue collecting bank.

ii. Schedule of WHT deducted indicating the : Name of supplier/vendor, Taxpayer Identification Number (TIN) of company or individual (supplier/vendor) from which the tax was withheld and the related amount.

6. How do you pay WHT?

WHT is paid into the Federation Account through all FIRS designated revenue collecting banks.

What is Value Added Tax?

Value Added Tax (VAT) is a tax levied on consumption of goods and services.

On what types of goods and services do you pay VAT?

The VAT Act CAP.VI LFN 2014 requires that you pay VAT on all goods manufactured /assembled in or imported into Nigeria, and all services rendered by any person in Nigeria except those specifically exempted under the law as follows: basic (raw) food items, baby products, medical services and services rendered by Community Banks etc.

What is the VAT rate?

5 per cent

What is the due date of filing VAT returns?

On or before the 21st day of the month following the month of transaction.

What are the relevant documents required for filing VAT returns?

i. Evidence of payment such as bank teller, e-ticket, e-acknowledgement etc. from an FIRS designated revenue collecting bank

ii. Completed VAT Returns Form 002 (for individuals, enterprises and companies)

iii. Schedule of VAT collected indicating the: Name, Taxpayer Identification Number (TIN) of company or individual on whose transaction the VAT was charged and the related amount.

Please what can I do as we can not print our Receipt of payment as sent and can not access it. Please do something quick

Receipt for payment cannot be accessed through the link that was shared have a hard time and we need the receipt. Please do something urgently

Receipt for payment cannot be printed from the link given.

We cannot log into porter to print out our credit note. Please treat as urgent.

Our online registration could not be completed on account of Isolo Micro & Small Tax office, 22,Osolo Way, Ajao Estate, Lagos not being able to include our e-mail address,’topklassvipymail.com’ and our contact phone number, Because of this two things we cannot access our on-line receipts since this year, and our TCC certificate print out of 2017 till date. We are referred by your office at 22 Osolo Way, Ajao Estate, Lagos to contact The Executive Chairman FIRS, Through Director of ICT FIRS Abuja for them to resolve our case. Please help us whoever receive this comment.

I AM FROM NORTHRIDGE ENGINEERING LTD. WE RECEIVED A CREDIT NOTE BUT IT COULD BE OPENED TO SEE WHO MAKE THE PAYMENT ON OUR BEHALF.

PLEASE ADD MY E-MAIL ADDRESS.

Without a receipt you can not verify anything. When Payment is made through the bank either for VAT or WHT, How can we get receipt for our payment?

I cannot log into the porter to print my credit note. Please help.