payslips.sft.leeds.gov.uk View Payslip Online : Leeds City Council

Organization : Leeds City Council

Service Name : View Payslip Online

Country: United Kingdom

| Want to comment on this post? Go to bottom of this page. |

|---|

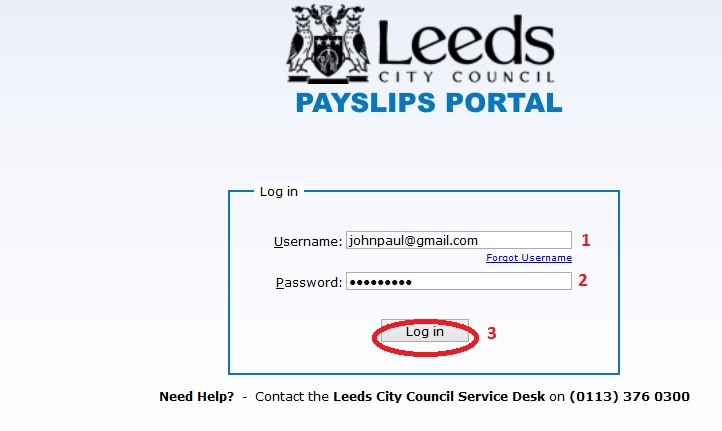

Website : https://payslips.sft.leeds.gov.uk/EFTClient/Account/Login.htm

Leeds View Payslip Online

You are about to access a secured government resource. Do not attempt to login unless you are authorised to do so.Leeds City Council reserve the right to monitor and/or limit access to this resource at any time.

Related / Similar Service : Leeds City Council Payslips

Need Help?:

Contact the Leeds City Council Service Desk on (0113) 247 6565

Payroll Services

Paying 38,000 people every month with an accuracy rate of 99.8%, we provide a customer focussed payroll service utilising industry leading SAP technology.

Our payroll service is provided by a team of experienced staff with specialist knowledge and expertise in local government and education payroll administration. We are fully conversant with teachers pay and conditions, as well as non-teaching staff pay agreements.

We also have extensive experience providing payroll services for non-educational establishments such as theatres, training agencies and independent small businesses.

Our services can be tailored to meet your requirements and include the following key services:

** a quality assured payroll process to ensure employees are paid accurately and on time, every time

** Real Time Information (RTI) – HMRC information exchange

** liaising directly with third parties such as HMRC and student loans company regarding deductions from salary and court orders

** administration of salary sacrifice schemes and voluntary deductions

** management of Local Government Pension Scheme (LGPS) and Teachers Pension Scheme (TPS), including statutory monthly and annual returns

** regular management reporting including staffing and finance reports

** secure pressure sealed payslips delivered on or before pay-day

** statutory and occupational payment calculations (including sickness and maternity pay)

** calculation of all statutory legislative requirements and reporting to government agencies

** processing of additional payments, overtime and travel expenses

** working closely with schools changing to academy status to ensure they are HMRC compliant and that staff are paid correctly post transfer

Apply for a Council Tax reduction

** This page explains the different ways in which you may be able to reduce the amount of Council Tax you pay.

Single Person Discount :

** Most of the time, if only one adult lives at a property, a 25% discount can be given. To see if you are entitled to a single person discount and/or apply for one, see our Single Person Discount page.

Reduction for disabilities :

** People who are permanently disabled can qualify for a reduction in their Council Tax if they use a wheelchair indoors or if their home has certain features – see the related page ‘Reductions for people with disabilities’.

Other discounts :

** When more than one adult lives in a property there are other discounts which will help you reduce your Council Tax. This is because some people are disregarded.

The types of people who are ‘disregarded’ are :

** some young people, youth training trainees and apprentices

** full-time students (see related page ‘Students and council tax’)

** non-British spouses or dependants of full-time students (as above)

** student nurses (as above)

** carers

** residents in care homes, certain hostels or long-term hospital patients

** people who are severely mentally-impaired and receive certain benefits

** people in prison, on remand or being held in hospital

** members of religious communities

** members of visiting forces or international headquarters and defence organisations.

** If, after disregarding a person, the number of resident adults is only one, a 25% discount can be given. To claim one of these discounts please fill out the appropriate form, which can be found in the Documents section on this page.

Removing Discounts :

** If you need to tell us that you’re no longer eligible for a discount or exemption, you’ll need to give us a call on 0113 222 4404

Annexes :

** From 1 April 2014, in certain circumstances, a 50% discount can be granted for an annex. More information is available below.

Council Tax Support :

** People with a low income might be able to get Council Tax Support. This could cover some or all of the Council Tax bill. For more information see the related page ‘Council Tax Support’.

Council Tax exemptions :

** Some properties are exempt from Council Tax so nothing is payable for them – see the related pages ‘Exemptions for occupied properties’ and ‘Exemptions for unoccupied properties’.