ez.hasil.gov.my eFiling/ Filing Income Tax Return Online Malaysia : Inland Revenue Board

Organization : Inland Revenue Board of Malaysia

Type of Facility : eFiling/ Filing Income Tax Return Online

Country: Malaysia

| Want to comment on this post? Go to bottom of this page. |

|---|

Website : https://www.hasil.gov.my/

File Here : https://ez.hasil.gov.my

How To Do Income Tax Return Filing Online?

An application on filling and filing Income Tax Return Form (ITRF) electronically through internet for the following Forms:

Related / Similar Facility : Tax File Registration Via e-Daftar Malaysia

Form B/BT (e-B/e-BT) – Resident Who Carry On Business/Knowledge/Expert Worker

Form BE (e-BE) – Resident Who Does Not Carry On Business

Form P (e-P) – Partnership Return Form

Form M/MT (e-M/e-MT) – Return Form of a Non-Resident Individual/Knowledge Worker

Form E (e-E) – Return form of An Employer

Form C (e-C) – Return Form of A Company

Form R (e-R) – Statement of Revised 108 Balance

e-Estimated (e-CP204) For Company/Co-operative Society/Trust Body – Company Tax Estimate Form (CP204)/Company Tax Estimate Form Amendment – 6 (CP204A-Amendment 6)/Company Tax Estimate Form Amendment – 9(CP204A-Amendment 9)

How To Get PIN Number?

** Income Tax Reference Number and PIN Number

** Pentium III and above

** Internet line

** Microsoft Windows 2000 (Latest service pack)

** Microsoft Windows XP (Latest service pack)

** Internet Explorer 8.0 and above/ Mozilla Firefox 5/ Opera 9/ Safari

How to get the PIN No.?:

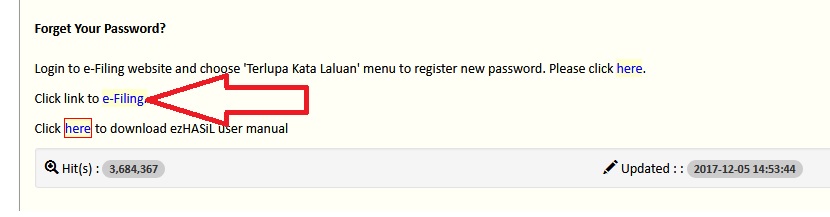

If email address is registered with IRBM – kindly apply via ezHASiL web. Please click here.

If email address is not registered with IRBM – kindly apply via online Feedback Form. Please click here. Please select e-filing PIN individual.

or please visit the nearest IRBM branch office.

Access To Ezhasil Website:

Browse the official ezHASiL website at this link, https://ez.hasil.gov.my/CI/.

Login (Log Masuk):

This function is used by both individual and organization users. Each user must activate their PIN first using First Time Login (Login Kali Pertama) in order to get their digital certificate.

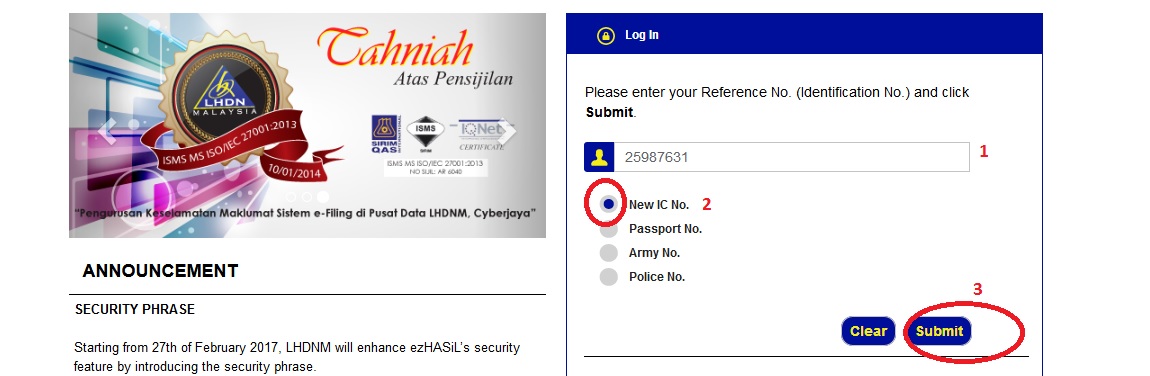

i. Browse https://ez.hasil.gov.my/CI/.

ii. Enter Identification Number (No. Pengenalan) and correct Password (Kata Laluan) and click Send (Hantar) button.

iii. The list of services offered can be viewed by clicking the Services (Perkhidmatan) menu

Profile Page (Laman Profil):

The profile page for the user will be displayed upon successful login into the system. The profile page can be displayed again by clicking the Profile (Profil) menu on the top right of the screen.

On the profile page, the system will display:

Basic Information (Maklumat Asas) – Name, Reference Number (Identification Number), Tax Reference Number, Address, Telephone Number, Branch.

Individual Digital Certificate (Sijil Digital Individu) – Certificate Status and Certificate Validity.

Organization Digital Certificate (Sijil Digital Organisasi) – Certificate Status, Certificate Validity and Organization information’s table (for individuals with Organization digital certificate).

Note:

Individuals who owns both individual and organization digital certificate will only be able to see both certificate’s information if the password for both certificate is identical.

FAQ On eFiling

Frequently Asked Questions (FAQ) On eFiling

1) What is e-Filing?

e-Filing is a method to submit the Income Tax Return Form electronically via Internet.

2) Does everyone need e-Filing?

It is recommended for taxpayers to use e-Filing as it is Easy, Fast and Secure.

3) How does the e-Filing process works?

a) Taxpayer that already has a registered Digital Certificate :

** Visit the ezHASiL website (ez.hasil.gov.my) or click the e-Hasil icon on the LHDNM main page (.hasil.gov.my)

** Log in to ezHASiL. Enter your Identification Card No. and Password.

** Select Service -> e-Filing -> e-Form. Select the applicable e-Form.

** Sign using Digital Certificate and submit via online submission.

** Print the e-Form acknowledgement page.

Functions of Inland Revenue Board of Malaysia

The Inland Revenue Board of Malaysia (IRBM) is the government agency responsible for collecting taxes in Malaysia.

Its functions include:

** Administering the Malaysian tax system: The IRBM is responsible for interpreting and enforcing the Malaysian tax laws. This includes issuing rulings and guidelines on tax matters, as well as conducting audits and investigations.

** Collecting taxes: The IRBM is responsible for collecting taxes from individuals and businesses in Malaysia. This includes collecting income tax, property tax, and sales tax.

** Providing taxpayer services: The IRBM provides a variety of taxpayer services, such as providing information on tax laws, helping taxpayers file their returns, and resolving taxpayer disputes.

** Promoting voluntary compliance: The IRBM promotes voluntary compliance with the Malaysian tax laws. This includes providing taxpayer education and outreach programs, as well as working with taxpayers to resolve their tax problems.

** Enforcing tax laws: The IRBM enforces the Malaysian tax laws against taxpayers who fail to comply. This may involve issuing penalties, seizing assets, or prosecuting taxpayers in court.

Several times, I am trying to submit my 2017 Income tax for Form E, but the system keeps on pop up E-filling. Please advice.

After Tax submission how many days it will take to Tax refund?

I made a mistake in my BE 2015 online submission. How do I to correct it?