mra.mu Quarterly VAT Return Filing & Tax Payment Mauritius : Revenue Authority

Organization : Mauritius Revenue Authority

Type of Facility : Quarterly VAT Return Filing & Tax Payment

Country: Mauritius

Website : https://www.mra.mu/index.php

| Want to comment on this post? Go to bottom of this page. |

|---|

MRA Quarterly VAT Return

You are strongly recommended to use Internet Explorer 6.0 or above

Related : Mauritius Revenue Authority E-Filing Individual Tax Return : www.statusin.org/8560.html

General Information for Electronic Filing of Quarterly VAT Return and Payment of Tax:

To use the efiling facility, you must have Adobe Reader version 8.0. You will be able to submit only one VAT return for each quarter. In case you wish to amend the figures in a return already sent, please include the change as an adjustment in line 11 of your VAT return for the following quarter.

A statement showing the details of the adjustment must be sent to MRA and the net figure should be shown indicating clearly whether it is an increase or decrease.

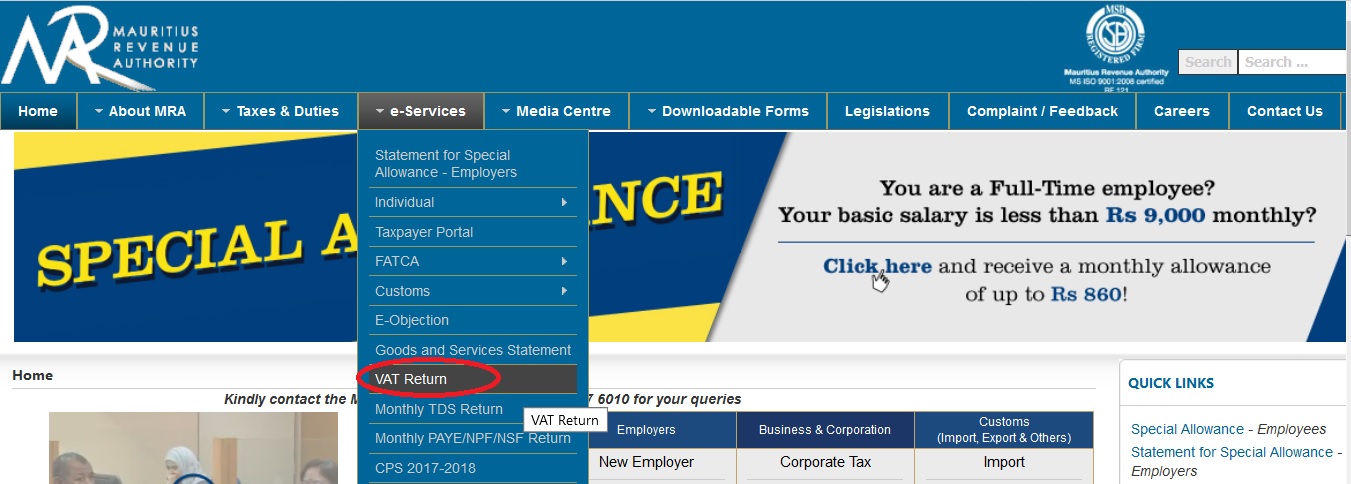

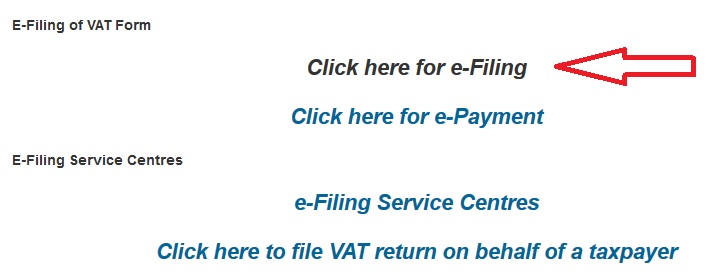

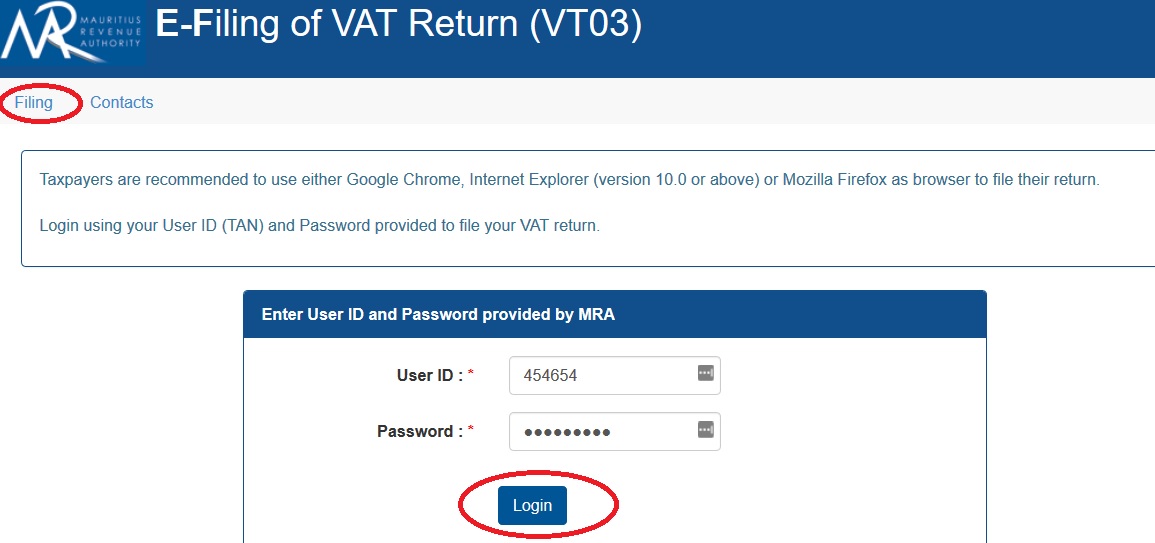

Filing of VAT Return

Enter your TAN and Password, click on “Login”. Select the taxable period which is applicable and click “Start Filing” to access your online form.

Your TAN, Name, Taxable Period and correspondence address will automatically appear on the form. In case there are changes in your personal data, kindly fill in a “Personal Data change Form” available here or MRA Service Counter and send it to MRA.

Ensure that you have all the required information before you begin. No document need to be submitted if you file electronically but all required information must be inserted. While filling the return, please insert a valid e-mail address in order to obtain an acknowledgment confirming that your return has been received by MRA for further processing.

To move from one field to another, click on tab key on your keyboard. While inserting the figures in the form, the tax will be calculated automatically.

If you wish to print a copy of your form, please do so before you submit the return online. After submission, kindly print the acknowledgement confirmation for payment purposes.

Mode of Payment

Direct Debit

To make use of this payment facility, you should fill in a “Direct Debit Application Form” available here or MRA Service Counter and send it to MRA Head Office before the due date for filing the return for onward processing to your bank. Taxpayers, who have already availed themselves to this payment facility, need not fill in a new “Direct Debit Application Form”.

Cash / Cheque

Payment may be made by cash or cheque at MRA cash counters, Ehram Court, Port Louis, from Monday to Friday (09.00 hrs to 15.30 hrs). While effecting payment, please ensure you have your Tax Account Number (TAN), the amount of tax and a copy of the acknowledgement confirmation.

Cheques drawn to the order of the Director General MRA crossed “MRA A/C” or “Account Payee Only” may be sent by post. Please write your name, Tax Account Number (TAN) and the taxable period on verso of cheque. The cheque should reach the MRA Headquarters, Ehram Court, Port Louis not later than 20 days after the end of the taxable period.

Support Services :

For further information, you may call at the Customer Service Desks, ground floor,MRA Headquarters, Ehram Court, Corner Mgr Gonin & Sir Virgil Naz Streets, Port Louis or call us on our Hotline 2076010.