ira.go.ke Agents Brokers & MIPs Online Registration Kenya : Insurance Regulatory Authority

Name of the Organization : Insurance Regulatory Authority

Type of Facility : Agents Brokers & MIPs Online Registration

Country : Kenya

| Want to comment on this post? Go to bottom of this page. |

|---|

Website : http://www.ira.go.ke/index.php

IRA Agents Brokers & MIPs Online Registration

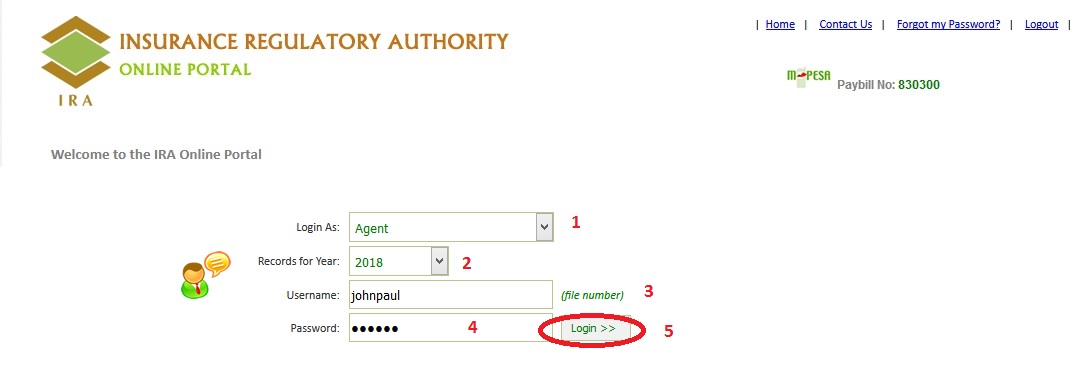

Login Guidelines :

(a) For Existing Users:

Login As: Choose the appropriate category that suites you (e.g. Agent, Broker, Reinsurance Broker or MIP).

Application for Year: Choose the specific year that matches the application (e.g. 2014 or 2015).

Related : Insurance Regulatory Authority Kenya Insurer Registration : www.statusin.org/7079.html

Username: Use the file number as the username (e.g. IRA/05/12011/2015, username will be ‘12011’).

Password: Use the national ID or passport number of the Principal Officer as the default.

(b) For New / First Timer Applicants:

First register as an Online Portal User to proceed.

Once registered, for Username, use the national ID or passport number of the Principal Officer.

Password: Use the national ID or passport number of the Principal Officer as the default.

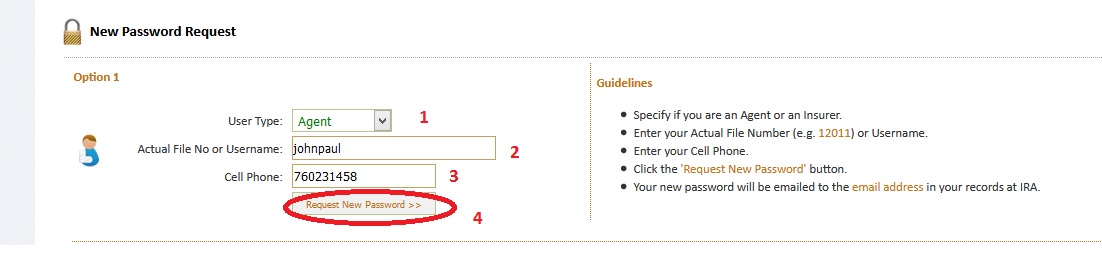

New Password Request

Guidelines:

Specify if you are an Agent or an Insurer.

Enter your Actual File Number (e.g. 12011) or Username.

Enter your Cell Phone.

Click the ‘Request New Password’ button.

Your new password will be emailed to the email address in your records at IRA.

Option 2:

Call IRA on 0800 724 499 or email agentslicensing AT ira.go.ke.

Your new password will be availed to you on email or phone after appropriate identification check by IRA staff.

Talk to Us:

Tel: (254)-020-4996000, 0719 047 000

Toll Free No: 0800 724499

FAQS

Who is IRA?

The Insurance Regulatory Authority (IRA) is Government institution responsible for the regulation of the insurance industry in Kenya. IRA does not, therefore, sell insurance products.

What is Insurance?

Insurance is a mechanism through which persons transfer risk(s) to insurance companies at a fee called premium. The insurance companies in return promise to pay for the insured loss should it occur.

How many Forms of Insurance are there?

There are two forms of insurance namely life (long term) and general (short term). Life insurance are contracts for more than one year while general insurance contracts are for one year or less.

Can I cancel my policy if I am not satisfied with its terms and conditions?

Yes. Under life insurance policy this action must be taken within the first thirty days after receiving the policy document. In case you cancel the policy within the thirty days, you will be refunded the whole premium paid less withholding tax. . Regarding general insurance business, cancellation of the policy will lead to a prorata refund of the premiums so far paid.

What happens to my policy if I fail to pay insurance premium?

Failure to pay insurance premiums as stipulated in the policy amounts to breach of policy terms and conditions and leads to the termination of the contract.

What happens to my policy if I fail to pay insurance premium?

Failure to pay insurance premiums as stipulated in the policy amounts to breach of policy terms and conditions and leads to the termination of the contract.

How do I make an insurance claim?

You will need to report any loss or damage to the insurance company in time and ensure that you submit all the necessary documents requested by your insurance company. You are required to co-operate with the insurance company to facilitate the smooth handling of the claim.

Agent application for 2016 dialogue boxes are not in active. What can I do?

Kindly contact the helpdesk

Tel: (254)-020-4996000, 0719 047 000

Toll Free No: 0800 724499