Kenya Revenue Authority (KRA) : Invoice Number Checker

Organisation : Kenya Revenue Authority (KRA)

Facility Name : Invoice Number Checker

Country : Kenya

Website : https://itax.kra.go.ke/KRA-Portal/main.htm?actionCode=showOnlineServicesHomeLnclick#

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Check KRA Invoice Number Online?

To Check Kenya Revenue Authority (KRA) Invoice Number Online, Follow the below steps

Related / Similar Facility : Kenya Revenue Authority Agent Checker

Steps:

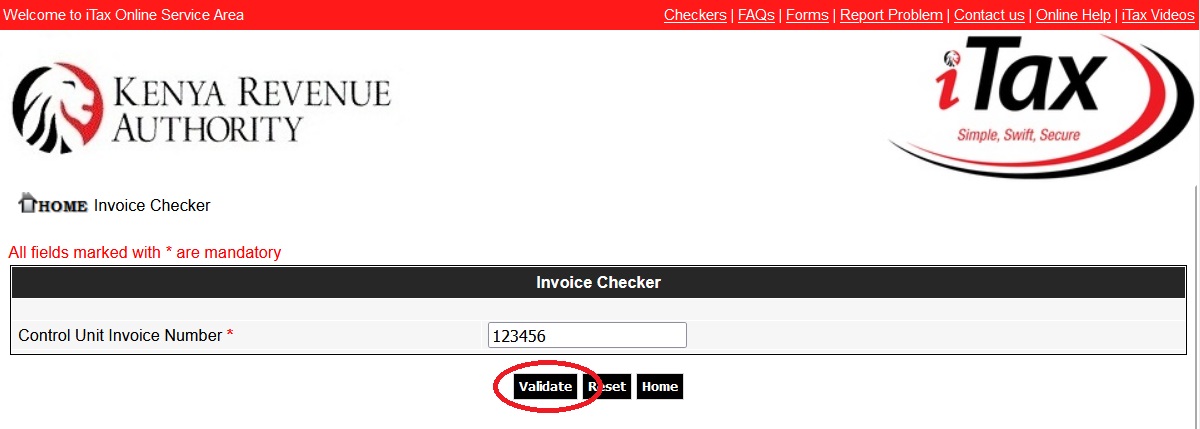

Step-1 : Go to the link https://itax.kra.go.ke/KRA-Portal/invoiceNumberChecker.htm?actionCode=loadPageInvoiceNumber

Step-2 : Enter the “Control Unit Invoice Number” in the space provided

Step-3 : Click On “Validate” Button.

FAQ On Kenya Revenue Authority (KRA)

Frequently Asked Questions FAQ On Kenya Revenue Authority (KRA)

How can I know my PIN and station if I have my ID?

You can query through dialling (572) from your mobile phone and follow the steps to get the information. You are charged a small fee of Kshs 5.

Does KRA offer training on iTax?

i.Yes. Training is done free of charge every Thursday at 5th floor Times Tower. You can also visit our nearest KRA office.

ii.User guides are also available at KRA offices and website to provide step by step instructions on how to navigate through the iTax system.

iii.KRA intends to partner with appointed, licensed and trained Intermediary Agents who will assist taxpayers in Registration and filing of tax returns.

iv.KRA registered Tax Agents (Including ICPAK/ LSK members) will be enabled to transact on iTax on behalf of taxpayers using their own log in credentials.

How secure is my information on iTax? Does KRA intend to secure taxpayers information by ensuring that no other party has access to the files once the data is uploaded on to KRA website? Who will be able to access the system and who will not?

1.Some of the security features integrated into iTax are

2.During the update of registration details, the taxpayer is required to provide an email address that is unique for every PIN registered. The security features for the creation of a password have been strengthened and the taxpayer is at liberty to determine the strength of his/her password. In addition the security question authenticates the rightful user on issuance of a new password.

3.The security stamp provided upon log in is to prevent phishing programs that attempt to hack into the taxpayers iTax account.

4.There is an on-going Government initiative under the National Public Key Infrastructure (PKI) Project in which KRA is a pilotee. This security feature will enable taxpayers to securely transact on iTax and verify their identity via digital signature.

Contact

Through email Callcentre@kra.go.ke and DTDOnlineSupport [AT] kra.go.ke or call 020 2390919 and 020 2391099 and 0771628105 or visit the nearest KRA office

Here are some additional tips for checking KRA invoice numbers online:

** Make sure that you enter the invoice number correctly, including any hyphens or spaces.

** If you are not sure of the invoice number, you can contact the supplier who issued the invoice.

** You can also check the KRA website for a list of approved Electronic Tax Register (ETR) suppliers. ETR suppliers are authorized to issue KRA-compliant electronic tax invoices.

** If you find that a KRA invoice number is not valid, you should contact the supplier who issued the invoice and ask them to issue a corrected invoice.