CDA Philippines : Credit Surety Fund Cooperative Information System (CSFC-IS)

Organisation : Cooperative Development Authority (CDA)

Facility Name : Credit Surety Fund Cooperative Information System (CSFC-IS)

Country : Philippines

Website : https://cs.cda.gov.ph/users/login

| Want to comment on this post? Go to bottom of this page. |

|---|

What is CSFC-IS?

The Credit Surety Fund Cooperative – Information System (CSFC-IS) is the first version of a full automation and online pre-processing for the application of BSP organized or new organized credit surety fund cooperatives.

Related / Similar Facility : CDA Philippines Cooperative Assessment Information System (CAIS)

How To Access CSFC-IS System?

To Access CSFC-IS System, Follow the below steps

Steps:

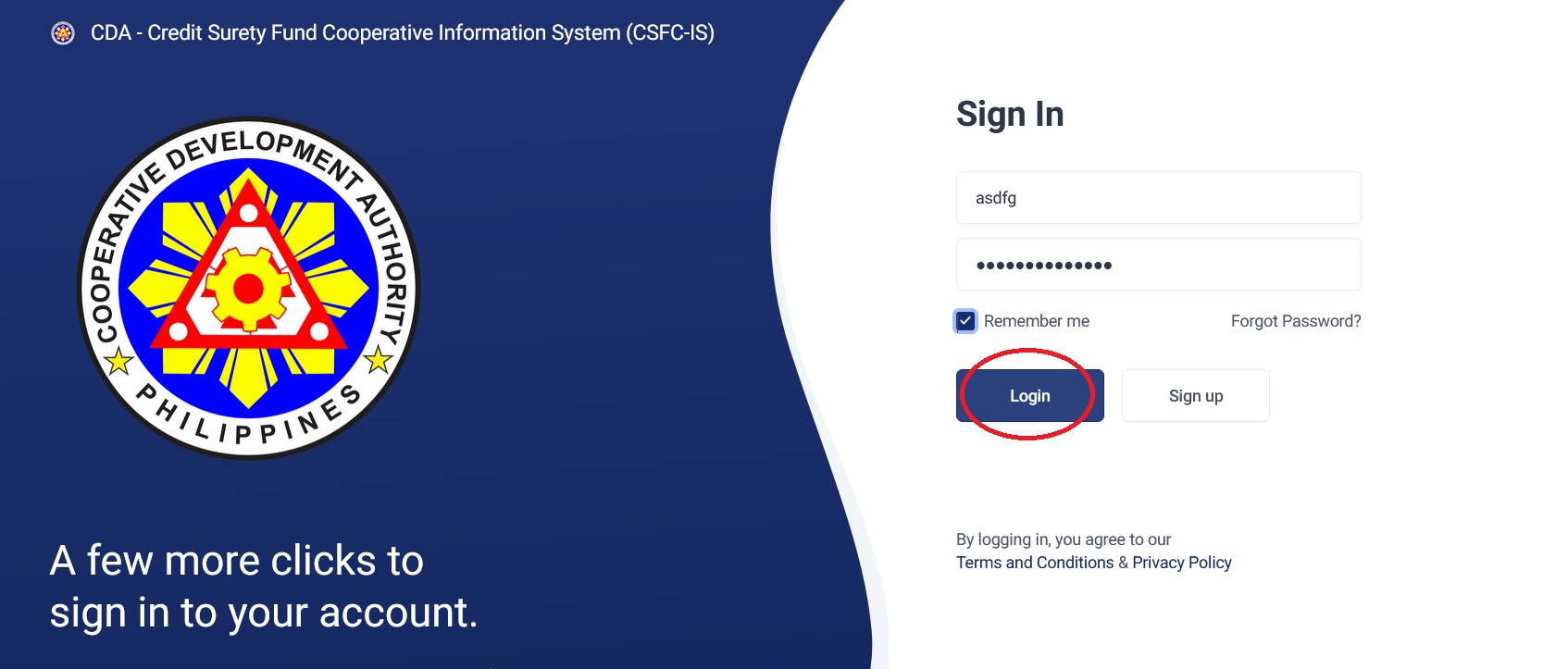

Step-1 : Go to the link https://csf.cda.gov.ph/Login

Step-2 : Click on the link “Sign Up”

Step-3 : Fill the Online Registration form and Submit.

Step-4 : After Successful Registration, Enter your Username and Password in the space provided and

Step-5 : Click On “Login” Button to access Credit Surety Fund Cooperative – Information System (CSFC-IS).

Benefits of CSFC-IS System

The Credit Surety Fund Cooperative Information System (CSFC-IS) is a centralized electronic platform that provides a single point of access for credit surety fund (CSF) cooperatives to manage their operations and interact with their members.

The system offers a number of benefits, including:

Improved efficiency and productivity: CSFC-IS automates many manual tasks, such as loan application processing, risk assessment, and reporting. This frees up CSF cooperatives to focus on their core business of providing credit to small and medium-sized enterprises (SMEs).

Enhanced transparency and accountability: CSFC-IS provides a real-time view of all loan transactions and financial data. This helps to improve transparency and accountability within CSF cooperatives and reduce the risk of fraud.

Improved risk management: CSFC-IS includes a number of risk management features, such as credit scoring and fraud detection. This helps CSF cooperatives to better assess and manage the risk associated with their lending activities.

Reduced costs:CSFC-IS helps CSF cooperatives to reduce costs by eliminating the need to develop and maintain their own IT systems. It also provides economies of scale by aggregating the data and transactions of multiple CSF cooperatives on a single platform.

Improved member service: CSFC-IS provides CSF cooperatives with the ability to offer their members a more convenient and efficient way to access their services. For example, members can use the system to submit loan applications, track the status of their loans, and make payments online.

Note:

Overall, CSFC-IS is a valuable tool that can help CSF cooperatives to improve their efficiency, productivity, transparency, accountability, risk management, costs, and member service.

Here are some specific examples of how CSFC-IS can benefit CSF cooperatives and their members:

** A CSF cooperative can use CSFC-IS to process a loan application in minutes, compared to hours or even days using traditional methods. This can help the cooperative to approve and fund loans more quickly, which can be critical for SMEs that need access to capital quickly.

** CSFC-IS can help a CSF cooperative to identify and mitigate risks associated with its lending activities. For example, the system can use credit scoring to assess the risk of a loan applicant and fraud detection to identify suspicious transactions. This can help the cooperative to reduce the risk of defaults and fraud.

** CSFC-IS can help a CSF cooperative to reduce costs by eliminating the need to develop and maintain its own IT systems. The cooperative can also save money on software licensing and maintenance fees.

** CSFC-IS can help a CSF cooperative to improve its member service by providing members with a convenient and efficient way to access their services. For example, members can use the system to submit loan applications, track the status of their loans, and make payments online.

Note:

Overall, CSFC-IS is a powerful tool that can help CSF cooperatives to improve their operations and better serve their members.

Contact

Call : (123) 456-7890

Email : helpdesk [AT] cda.gov.ph