Pag-IBIG Fund Developer’s Online Housing Loan Application Philippines : pagibigfund.gov.ph

Organisation : Pag-IBIG Fund

Facility Name : Developer’s Online Housing Loan Application

Applicable State/UT : Philippines

Website : https://pagibigfund.gov.ph/index.html

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Apply For Pag-IBIG Fund Developer’s Online Housing Loan?

To apply for Pag-IBIG Fund Developer’s Online Housing Loan Philippines, Follow the below steps

Steps:

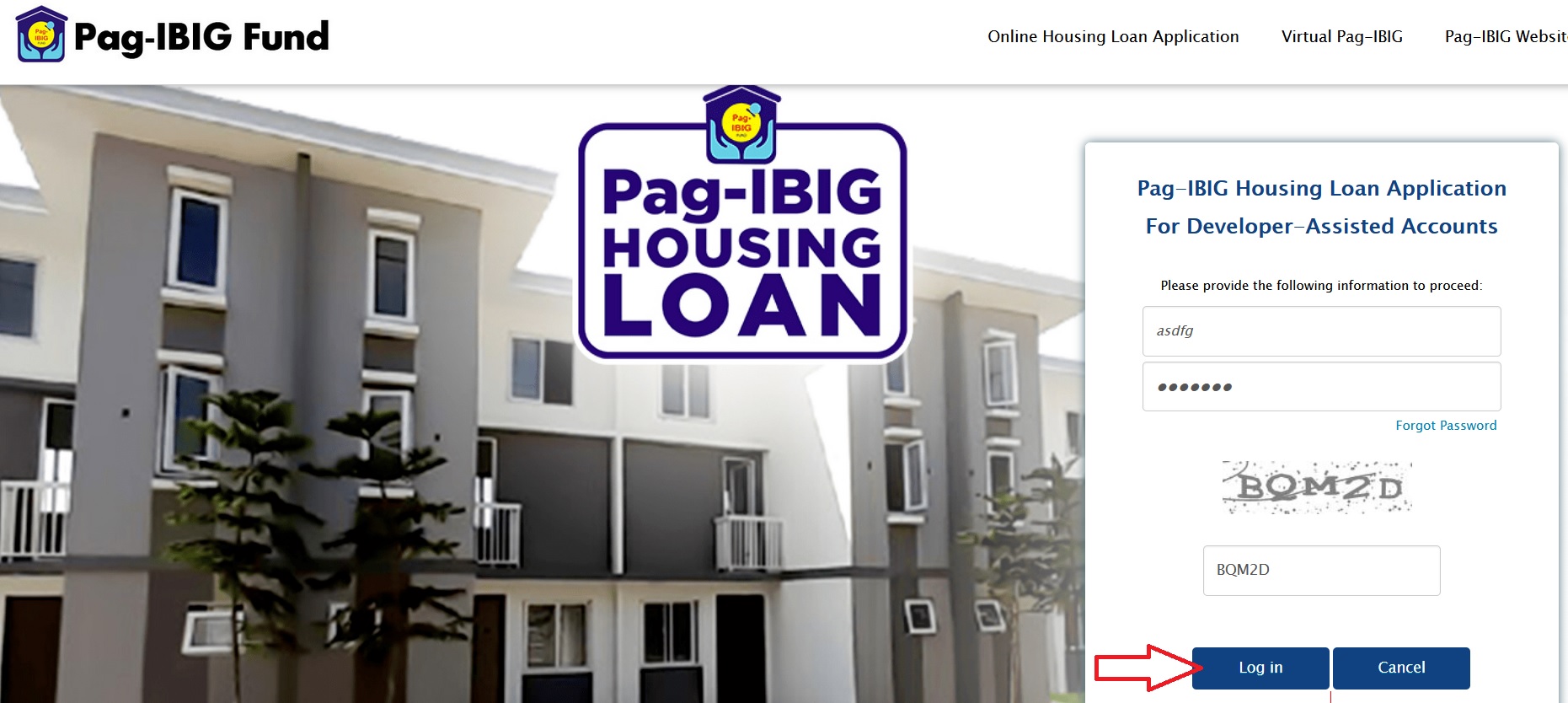

Step-1 : Go to the link https://www.pagibigfundservices.com/HLDeveloper/Account/Login.aspx

Step-2 : Enter your Username and Password

Step-3 : Enter the Captcha code and

Step-4 : Clck on Login button

FAQ On Virtual Pag-IBIG

Frequently Asked Questions FAQ On Virtual Pag-IBIG

What is Virtual Pag-IBIG?

The Virtual Pag-IBIG is Pag-IBIG Fund’s online service facility that allows you to safely and conveniently access Pag-IBIG Fund’s services anytime, anywhere using just your smartphone or computer with internet connection. It also provides a chat service with a Lingkod Pag-IBIG service officer ready to answer your inquiries or concerns. It’s like having your own Pag-IBIG Fund branch ready to serve you 24/7!

What services does the Virtual Pag-IBIG offer?

By simply visiting www.pagibigfundservices.com/virtualpagibig, you can immediately enjoy the following services:

** Register as a Pag-IBIG Fund member and get your permanent Membership ID (MID)Number;

** Open a MP2 Savings Account;

** Apply for a Pag-IBIG Multi-Purpose Loan (MPL);

** Apply for Pag-IBIG Calamity Loan (for members whose area of residence is declared under a state of calamity);

** Take the first step in applying for a Pag-IBIG Housing Loan;

** Apply for a Pag-IBIG Home Equity Appreciation Loan (HEAL);

** View the status of your loan (Housing, Multi-Purpose, Calamity or Home Equity Appreciation Loan);

** Top-Up your Pag-IBIG Regular Savings;

** Save in the Pag-IBIG MP2 Savings;

** Pay your Pag-IBIG loans (Housing, Multi-Purpose, Calamity or Home Equity Appreciation Loan);

** Apply for Interest-Rate Repricing on your Housing Loan;

** Claim your Pag-IBIG Savings (due to membership maturity, optional withdrawal of savings, retirement at age 65, and MP2 Savings maturity); and

** Chat with a Lingkod Pag-IBIG, 24/7, to help you learn more about your Pag-IBIG Fund benefits.

What added services will I enjoy with a Virtual Pag-IBIG account?

With a Virtual Pag-IBIG account, you can enjoy the following premium services:

** View your Pag-IBIG Regular Savings records, including the annual dividends it has earned;

** View your MP2 Savings records, including the annual dividends it has earned;

** View your loan records (payments made and the outstanding balance of your Housing, Multi-Purpose, or Calamity Loan); and

** View the account balance and transaction history of your Loyalty Card Plus (currently available for cards issued by Asia United Bank);

How can I access the Virtual Pag-IBIG?

Using just your smartphone or computer with internet connection, you can easily access the Virtual Pag-IBIG by visiting www.pagibigfund.gov.ph, and clicking on the Virtual Pag-IBIG, For Members link on the main menu. You may also click www.pagibigfundservices.com/virtualpagibig/ to directly access Virtual Pag-IBIG.

I don’t have a Virtual Pag-IBIG account. Can I still enjoy its services?

Yes! You can still have access to many of Pag-IBIG Fund’s services even if you do not have a Virtual Pag-IBIG account. However, to enjoy premium services, such as viewing your savings and loan records, you would need to create your own account. This is to ensure that your records with Pag-IBIG are kept safe.

Contact

Have any questions? 8-724-4244 (8-Pag-IBIG), contactus [AT] pagibigfund.gov.ph.