fbr.gov.pk : FBR Online Taxpayer Registration & Status Inquiry Pakistan

Name of the Organisation : Federal Board of Revenue (fbr.gov.pk)

Type of Announcement : Online Taxpayer Registration, Status Inquiry

Country : Pakistan

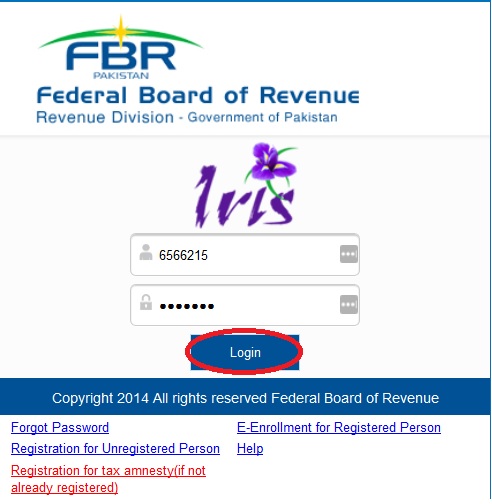

Website : https://iris.fbr.gov.pk/infosys/public/txplogin.xhtml

| Want to comment on this post? Go to bottom of this page. |

|---|

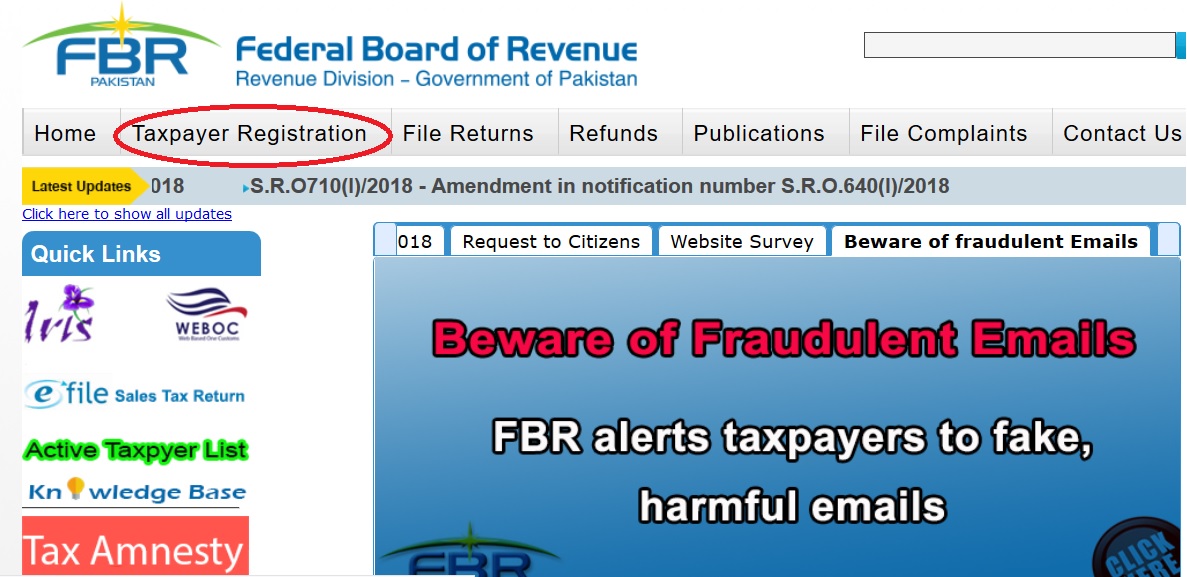

How To Do FBR Online Taxpayer Registration?

Now you have a Virtual Tax facilitation Center (TFC),NTN Cell, why visit Tax offices and submit application manually, if you can easily prepare and submit application electronically without leaving your office or home.

Related : FBR Taxpayer Online Verification Pakistan : www.statusin.org/1217.html

Save your precious time, apply for New e-Registration(NTN), apply for Sales Tax Number (STRN) , Change in Particulars and enjoy the benefits of e-Registration Services offered by FBR Pakistan.

FAQ On Registration

Frequently Asked Questions (FAQs) On Registration

1. What is e-Filing?

This is a facility provided to the taxpayers to file income tax returns/statements through internet.

2. What is e-Service?

E-Service is simply a way to serve your documents using internet and taxes online system. It saves time and, quite often, a significant amount of money over traditional methods. More information about eService.

3. What is the fee for e-Filing?

There’s no fee of e-Filing.

4. What are the benefits of e-Filing?

** E-Filing is fast, easy and safe.

** Convenient and accessible – Files relating tax can be accessed anytime from anywhere.

** No more standing in line to file your documents.

** 24 hours a day,7 days a week to file your documents.

5. What notification will I receive on my e-Filings?

After online submission your statements, you will receive an immediate acknowledgement. This comprises the date of submission and reference quote number.

6. What about customer support?

e-FBR provides unlimited toll-free technical support by phone as well as free training.

7. What are the benefits of e-file?

These are the benefits of e-filing;

Convenience : You can electronically file 24 hours a day, 7 days a week.

Security : Your tax return information is encrypted and transmitted over secure lines to ensure confidentiality.

Accuracy : Electronic filed returns have 13 percent fewer errors than paper returns.

Proof of Filing : An acknowledgment is issued when your return is received and accepted.

Direct Deposit. You can have your refund direct deposited into your bank account.

8. Is it safe and secure to e-file?

Yes! Your tax information is in encrypted and transmitted over secure computer network to ensure confidentiality.

9. Is there a fee for e-file?

The Central Board Revenue will not charge a fee for e-filing CBR offering this service to taxpayers not charges a fee for the preparation and/or submission any type of return.

10. How do I know if my e-filed return has been received?

Acknowledgments (electronic confirmations) are issued online through email. When the returns are received and approved. If there are no errors, an acknowledgment is usually received within 24 hours of the transmission.

If the server detects an error, an error message is sent back to you in your email address. Once the corrections are made, the returns are re-transmitted to the CBR Server.

11. Do I need to submit any paperwork or supporting document if I e-file?

No paperwork needs to be submitted when you electronically file your return through e-FBR. We advise you maintain copies of all documents for your records. In some cases, the department will notify taxpayers if documentation is needed for verification.

FAQ On e-Filing Enrollment

Frequently Asked Questions (FAQs) On e-Filing Enrollment

How to create enrollment to begin e-Filing?

To begin e-Filing CBR Returns and Statements please e-Enroll at e.fbr.gov.pk (Registration->Enrollment->Company/Individual)

For Company e-Enrolment :

Please make sure you are using NTN and Reg/Inc.No as printed on NTN Certificate.

Use Director NTN instead of CNIC, (Director NTN can be searched on CBR.gov.pk , NTN Verification Option)

For Individual e-Enrolment :

1. Entering your NTN and CNIC as it is printed on NTN Certificate.

2. Enter Secret Digits as it is given in Graphic Image at e-Enrolment Page.

Note : If the Director NTN is not associated during issuance of Company NTN, you may Fax the Director Particulars on Official Company Letter Head on Fax number: (051) 920 44 04.

Upon receipt of that fax we will associate him as Director of the Company so that e-Enrolment Process may be completed at your end. After completion of e-Enrolment process you will be issued User-ID and Password.

Address :

PRAL – Pakistan Revenue Automation (Pvt) Ltd.

5th Floor Evacuee Trust Complex,

Islamabad, Pakistan.

I forgot ID and Password. What steps should be taken to restore it?

I want to do coercion of my NTN number

Correct name : Faiz -ur Rehman Siddiqui but in registration it shows Fiaz-Ur-Rehman SIDDIQUI

REQUESTED YOU TO CORRECT MY name spelling as Faiz UR-Rehman Siddiqui

I lost code number

How I can get my NTN certificate print online which is already allotted to me?

Is gst registration compulsory for Export business?