Services Australia Parenting Payment Application : servicesaustralia.gov.au

Organisation : Services Australia

Facility Name : Parenting Payment Application

Country : Australia

Website : https://www.servicesaustralia.gov.au/parenting-payment?context=1

| Want to comment on this post? Go to bottom of this page. |

|---|

What is Services Australia Parenting Payment?

Parenting Payment is an income support payment that provides financial assistance to principal carers with parenting responsibilities for a young child and provides them with incentives to increase workforce participation and reduce dependency on income support.

Related / Similar Status : Services Australia Stillborn Baby Payment Application

The main income support payment while you’re a young child’s main carer.

To get this payment you must meet all of the following:

**be under the income and asset test limits

**meet principal carer rules for a child under 8 if you’re single, or under 6 if you have a partner

**meet residence rules

**your partner is not currently getting Parenting Payment.

How To Claim Parenting Payment?

Complete the following steps to claim Parenting Payment.

Parenting Payment – guide to claim

1. We will guide you through the claim process.

2. You can’t submit a claim for Parenting Payment before the birth of a child.

3. We generally assess your Parenting Payment from the date you submit your claim and documents.

4. We can backdate your payments if you submit your claim and documents within either 4 weeks of:

** your child’s birth

** the date the child came into your care.

5. Before you start, check if you’re eligible for Parenting Payment.

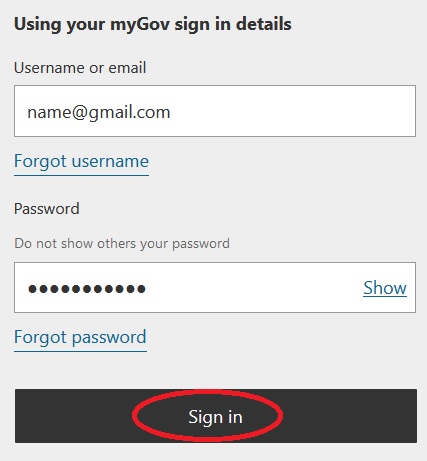

1. Setting up online accounts

Create a myGov account

**With myGov, you can access government services online.

**To get Centrelink payments and services, you need to create a myGov account and link it to Centrelink.

**You need your own email address to create a myGov account.

2. Supporting documents

| Documents | Details |

|---|---|

| Financial | You’ll need your tax file number (TFN). If you don’t have a TFN, you can apply to get one free on the ATO website.

You may need to give details of any financial assets. Listed below are documents you may need to complete your claim:

If you have a Self-Managed Superannuation Fund (SMSF) or a Small APRA fund (SAF), you’ll need to give us the latest annual member statement and the latest annual financial return for the fund. |

| Relationships | You may need to tell us your:

|

| Residence details if you’ve lived outside Australia | You may need to tell us your:

|

| Employment or work | If you’ve lost your job, you may need to give us an employment separation certificate and payslips.

You may also need to tell us about any income you’re paid from:

You may be able to get some documents through your ATO online account. Read more about what you can do in your ATO online account, on the ATO website. |

| Study | We may ask you to give us or confirm your:

If we ask you for proof of enrolment, we’ll need you to provide documents that:

|

| Medical | You may need to give us your:

|

3. Prove your identity

You need to prove your identity before you claim a payment or service.

If you want to claim a payment, you need a Center link Customer Reference Number (CRN). You can get a CRN by proving who you are with us, either:

** online

** over the phone

** in person at a service centre.

**If you’re having difficulties getting documents to prove your identity, you can contact us for help.

**What happens if you have an authorised nominee

**If you have a nominee dealing with us on your behalf, they can contact us to prove who you are. If we can verify your nominee over the phone, we’ll accept your identity details from them. We’ll let your nominee know if we need any further information.

**When you need to prove your partner’s identity

Your partner also needs to prove their identity with us, if you’re claiming one of the following:

** Parenting Payment

** Low Income Health Care Card

** Farm Household Allowance

** Home Equity Access Scheme.

They can do this over the phone.

If you’re claiming a Parenting Payment, or a Low Income Health Care Card, your partner isn’t required to prove their identity if they’re either,

** already getting an income support payment

** a current Centrelink Concession or Health Care Card holder.

Who Can Get Parenting Payment?

To get this payment, you must do all of the following:

**meet principal carer rules for a child under 8 if you’re single or under 6 if you’re partnered

**meet residence rules

**not have claimed before the birth of the child

**meet the assets test and be under the income limits.

You can’t claim Parenting Payment before the birth of a child. Only one parent or guardian can be paid Parenting Payment.

Parental Leave Pay is different to Parenting Payment. There are also other payments for families you may be able to get.

If your youngest child is younger than 6

You may need to take part in ParentsNext. You may also need to do both of these:

**agree to a participation plan

**do the activities you agree to do.

Financial support when your Disaster Recovery Allowance ends

You can claim an income support payment from us when your Disaster Recovery Allowance (DRA) or New Zealand DRA ends.

If you’ve lost your job you may be able to claim Parenting Payment.

How Much You Can Get Parenting Payment?

| Your circumstance | Your maximum fortnightly payment from 20 March 2022 |

|---|---|

| Single | $880.20 includes Parenting Payment and a pension supplement of $25.20. |

| Partnered | $585.30 |

| Partnered, separated due to illness, respite care or prison | $691.00 |