Application For e-Services : Botswana Unified Revenue Service

Name of the Organization : Botswana Unified Revenue Service

Type of Facility : Application for e-Services

Country : Botswana

| Want to comment on this post? Go to bottom of this page. |

|---|

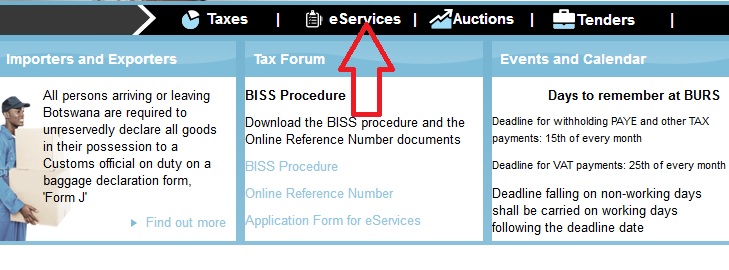

Official Website : http://www.burs.org.bw/

BURS Application For e-Services

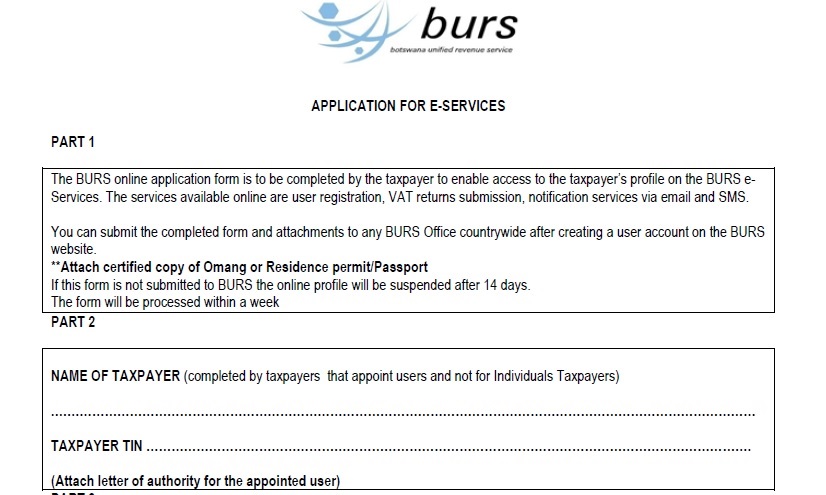

The BURS online application form is to be completed by the taxpayer to authorize access to the taxpayer’s profile on the BURS e-Services. The services available online are Taxpayer registration, VAT returns submission, notification services via email and SMS.

Related / Similar Service : Botswana Public Officers Welfare Fund

You can submit the completed form to any BURS Office :

** LTU (Relationship managers),

** Regional Offices (Managers),

Documents Required :

**Signed Letter of authority on letter head and taxpayer stamped

**Attach certified copy of Omang or Residence permit/Passport

If this form is not submitted to BURS the online profile will be suspended after 14 days.

The form will be processed within a week

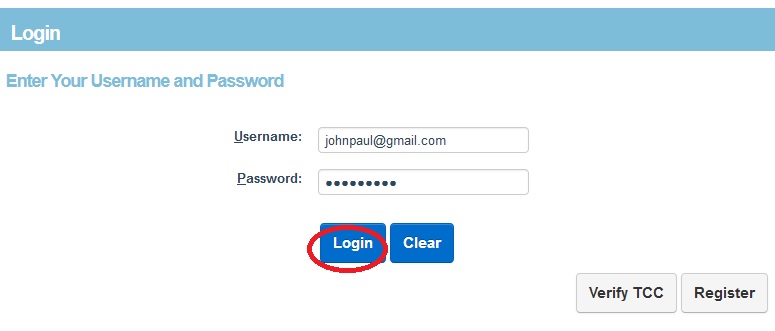

e-Services Login

Log In Information :

Email :

Please use your actual email as it will be used for sending of important messages and for your user account restoration in case your user account is lost.

Password :

Please select a strong password of no less than 10 characters and keep it secret from other persons. Do remember that strong and tightly kept password is the most important factor for the safety of your account.

We would like to assist:

Contact our call center for information @ | 17649

FAQ On BURS

Who heads the operations of BURS?

BURS is headed by a Chief Executive Officer, designated as Commissioner General.

When was it established?

The Botswana Unified Revenue Service (BURS) was established by an Act of Parliament in 2004, the Botswana Unified Revenue Service Act of 2003 and came into operation in August 2004.

Why was it formed?

BURS was established at a time when efficient tax collection was identified as a necessary part of the Government’s ability to fulfil both its governance and its civic duties..

Which Departments were merged?

The Departments of Customs & Excise and Taxes were brought together to form BURS. These now make up the core divisions of BURS namely Customs & Excise Division and Internal Revenue Division

What is the mandate of BURS?

The mandate of BURS is to perform tax assessment and collection functions on behalf of the Government of Botswana and to take appropriate measures to counteract tax evasion and to improve taxpayer service

Which Revenue Acts does BURS administer?

BURS administers 4 (four) Revenue Acts; Income Tax, Value Added Tax (VAT), Customs & Excise and Capital Transfer Tax

How is BURS spread across the country?

BURS has a head-office based in Gaborone, five regional offices in Francistown, Gaborone, Lobatse, Maun and Selebi-Phikwe, four satellite offices in Jwaneng, Mahalapye, Palapye and Serowe and is responsible for all borders, airports and airfields in the country.

About Us :

The mandate of the BURS is to perform tax assessment and collection functions on behalf of the Government and to take appropriate measures to counteract tax evasion on the one hand, and to improve taxpayer service to a much higher level on the other.

I have filled and submitted everything needed. I want to know, when I will be paid back because I have over taxed.

I want to fill up tax returns.

I have registered for E-services. I need my account to activity please.

I need a password for my BURS registration.

I have registered for E-services and was given a password. When trying it requires a password. But the password that I used is for the user name that I registered with. I tried to re-register and I received a note that I have already registered. Should I wait for the form to be submitted before that I can login using the password that was sent to me on 12/09/2016?