jamaicatax.gov.jm TAJ Property Tax Payment & Query Online Jamaica

Organization : Tax Administration Jamaica (TAJ)

Facility : Pay Property Tax Online & Check Status

Country : Jamaica

Website : http://www.jamaicatax.gov.jm/

| Want to comment on this post? Go to bottom of this page. |

|---|

What is TAJ Jamaica Property Tax Query Online Service?

Tax Administration Jamaica (TAJ) has introduced a Property Tax Query Online Service. Making it easier for persons to access information about their property tax status. The new online service was developed in an effort to offer further assistance and convenience to persons wanting information about their property taxes, without having to first visit a tax office.

Related / Similar Facility : Jamaica Taxpayer Registration Number (TRN)

How To Check TAJ Jamaica Property Tax Status Online?

The new online feature will allow persons to view their accounts to see what payments were made and what amount is outstanding. After viewing, persons may generate and print a Payment Advice, which they may take to any tax office.

Also, as a more convenient option persons may proceed to make payments online via the Jamaica Tax Portal (JTP). Also this service allows to view your property tax obligations, payments and outstanding amounts over seven years.

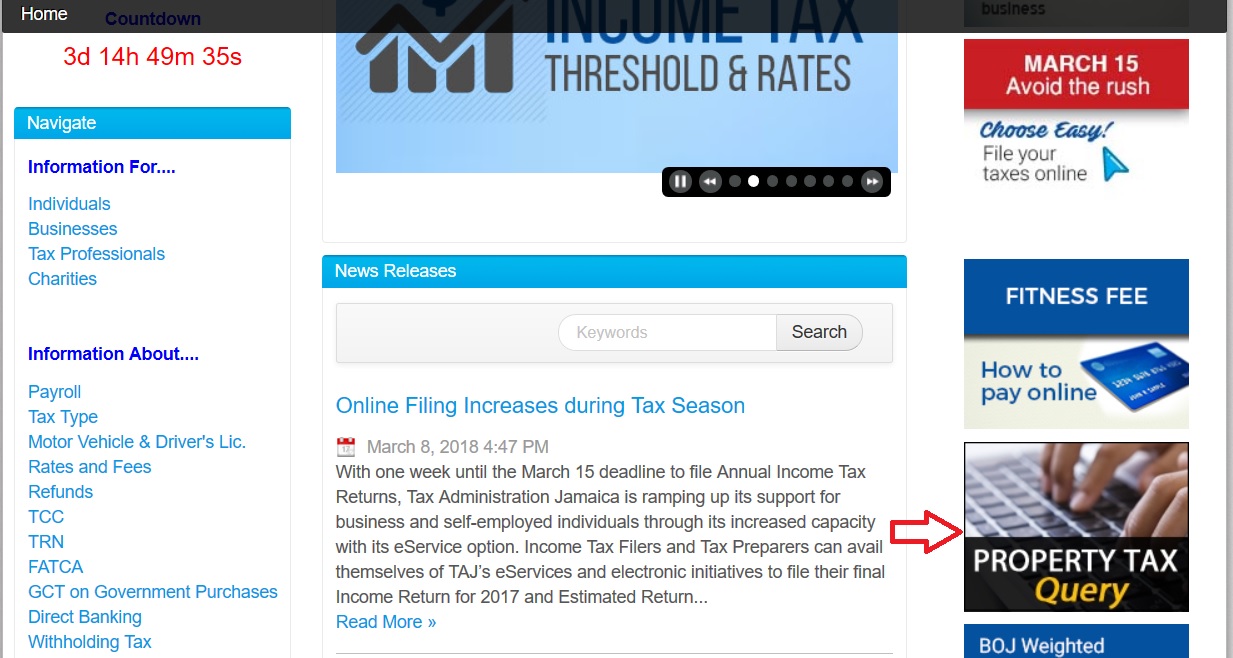

Go to the official website of Tax Administration Jamaica (TAJ) to check the property tax status. Then click on Property Tax Query link which is available in the right panel of website. Please use Google Chrome or Mozilla Firefox web browsers on this site.

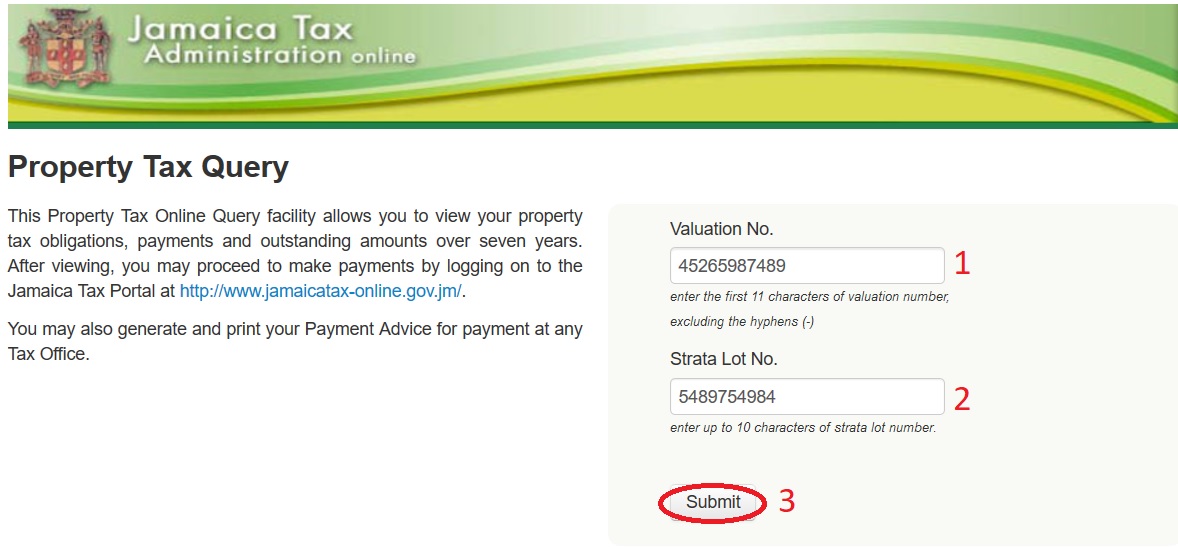

Step 1 : Enter the first 11 characters of valuation number, excluding the hyphens (-)

Step 2 : Enter up to 10 characters of strata lot number.

Step 3 : Click Submit Button

How To Pay TAJ Jamaica Property Tax Online?

To pay property tax online via the Jamaica Tax Portal persons would simply login, from the convenience of their home, office or anywhere and at any time.

Go to Tax Administration Jamaica (TAJ) website at jamaicatax.gov.jm.

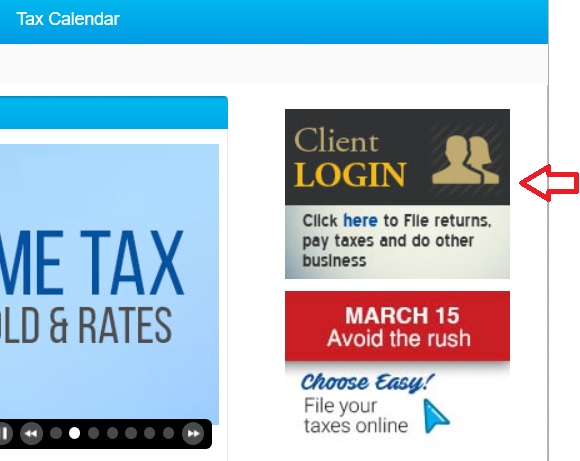

LOGIN: On the home page of the website jamaicatax.gov.jm click on the Login tab or the Client Login mini banner ad.

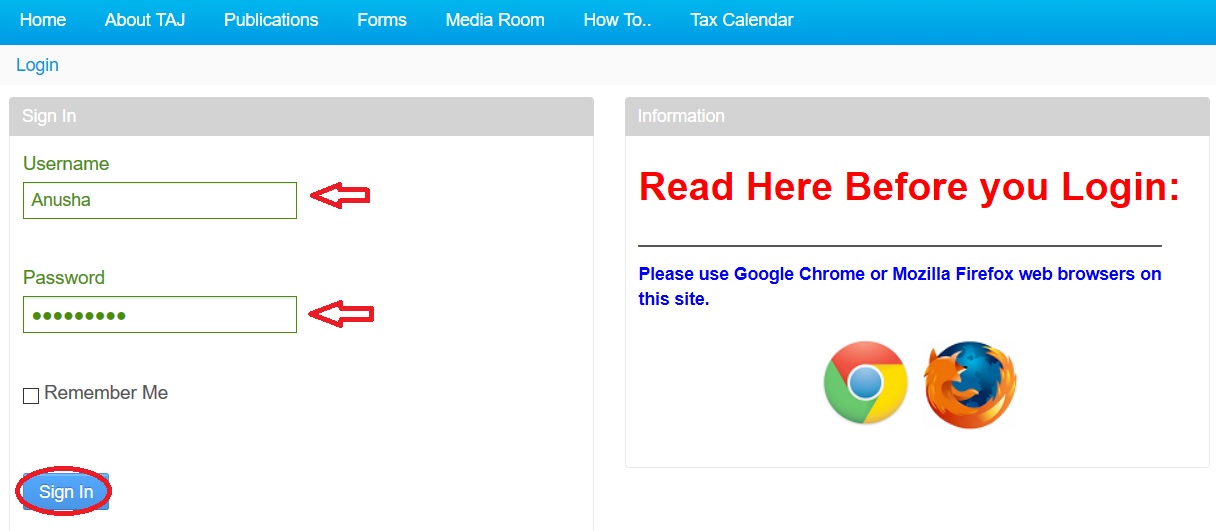

SIGN IN: Enter username and password, if you already have an account to make payment.

** Select the option to Pay Property Tax

** Enter the valuation number of the property and select the year then confirm tax details.

** Add to ‘today’s tax total’ and pay using credit card

** View and print &/or rite reference number for your records

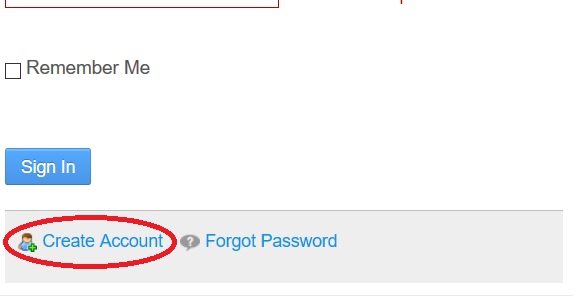

If you DO NOT already have an account, create account to make payment. Click Create Account link available in the login page.

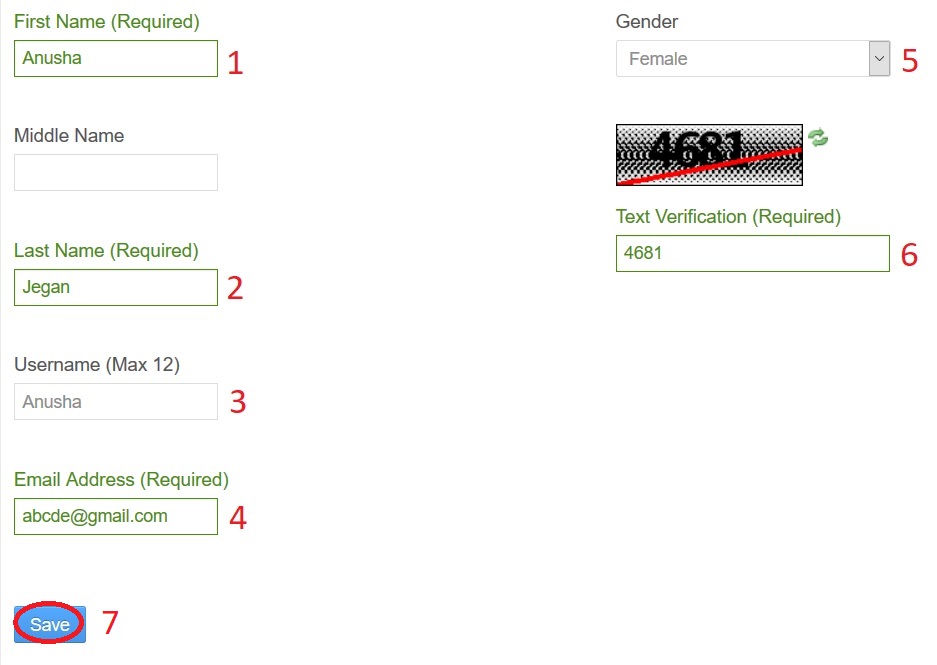

Step 1 : Enter First Name (Required)

Step 2 : Enter Last Name (Required)

Step 3 : Enter Username (Max 12)

Step 4 : Enter Email Address (Required)

Step 5 : Select Gender

Step 6 : Enter Text Verification (Required)

Step 7 : Click Save Button

Payment :

Review the information displayed. Using a Visa, MasterCard or Keycard credit card, enter the credit card data, making sure the information is correct.

Proof Of Payment :

Once the payment is completed you may email or print the Statement of Payment for your records.

Sign Out:

Record your reference number and/or Statement of Payment and transaction date, to take along with your TRN to the ITA location to complete the process. Once you have completed the transaction, remember to sign-out and close your browser.

For assistance, contact the Customer Care Centre at 1-888-Tax Help (829-4357).

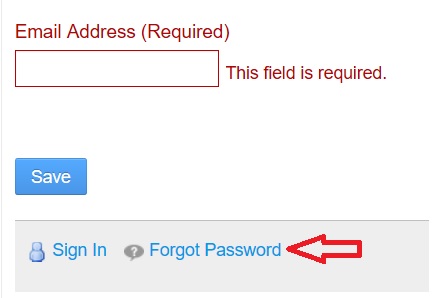

Forgot Password :

Click Forgot Password link available in the login page.

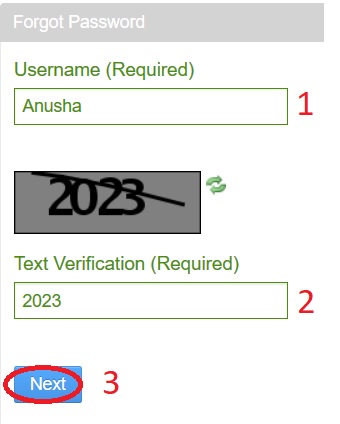

Step 1 : Enter Username (Required)

Step 2 : Enter Text Verification (Required)

Step 3 : Click Next Button

To pay online persons need :

** A valid Key Card, Master card or Visa card

** An Email Address

** Taxpayer Registration Number

Note :

** In addition to the online option, property owners are reminded that property tax payments may be made at any of the 29 tax offices across the island. Persons paying by cheque may also pay using the electronic drop boxes located in main tax offices.

** Property owners are encouraged to go in and have dialogue with a Compliance Officer, to make an arrangement to pay, if they are having a difficulty in settling their obligations.

TAJ Jamaica Contact

For further information persons may contact the Tax Administration Jamaica (TAJ) Customer Care Centre at 1-888-Tax-Help (1-888-829-4357) toll-free or visit our website.

FAQ On TAJ Jamaica Property Tax

Here are some frequently asked questions (FAQ) about TAJ Jamaica Property Tax:

What is TAJ Jamaica Property Tax?

TAJ Jamaica Property Tax is a tax that is levied on the value of real property in Jamaica. The tax is administered by the Tax Administration Jamaica (TAJ).

Who has to pay TAJ Jamaica Property Tax?

TAJ Jamaica Property Tax is payable by the owner of the property. If the property is owned by a company, the company is responsible for paying the tax.

When is TAJ Jamaica Property Tax due?

TAJ Jamaica Property Tax is due on April 1 each year. However, taxpayers can pay the tax in full, half yearly or quarter yearly instalments. Half yearly instalments are to be made on April1 and October 1 each year while quarterly instalments are to be made on April 1, July 1, October 1, and January 1.

How much is TAJ Jamaica Property Tax?

The amount of TAJ Jamaica Property Tax that is payable depends on the value of the property. The tax rate is 0.25% of the property’s assessed value.

I previously created an account that I last used 1 year ago. I have forgotten the username and password and I am unable to create a new account as my email address is already in the system. The “forgot password option” does not have an email option for recovery or resetting of my password. What can I do to regain access to the account?

i am unable o pay my property tax with debit card,becausei have forgot username and password please help me’

Hello: My father leased a 1/4 acre of crown land in a place called Hiattsfield in St. Ann. He has since passed away. It seems as if he was paying taxes along with a leasing fee on this property, or so it seems. Is it normal for people to pay taxes on land they lease from the government? If not, there might be an error made somewhere. I would really appreciate receiving a prompt response from the tax admin or anyone out there who has an answer to my question. Thanks.

Please could you advise, what area of land you are collecting taxes for as the area seem to varies between 1138.1780 sq meters and 404,6860 sq meters?

I need advice as to how to pay the property taxes for my father’s house in Spanish Town.

I have the Valuation number and lot number. How do I pay property taxes for a house in Spanish Town? When entered, it keeps saying there is no such property. What can I do?

I have forgotten both the Login Username and password. The reset option poses a problem. It does not accept the name entered and the email address is already used.

I RECEIVED A DOCUMENT ABOUT PARCEL OF LAND THAT I OWN IN DUNCANS BAY TRELAWNY. THE VALUATION NUMBER IS 013-03-023-077 VOLUME1094 FOLIO840. THE DOCUMENT SAYS THAT THE AREA OF LAND COMPRISING THE PARCEL IS 2.458 HECTARES. I WOULD JUST LIKE TO SAY THAT DEFINITION OR CLAIM IS TOTALLY INCORRECT. LOT 353 IS ONLY .5 OF AN ACRE. BUT BY MY MATHEMATICS IT IS 2025 HECTARES. ONE HECTARE IS EQUAL TO 100 METER BY 100 METER. SO PLEASE LOOK INTO THIS.

I paid my property tax online for several years, but in the last two years I have not paid because I forgot the password and some how the system seemed to have been updated. How can I get on line again to pay my taxes as it is now two years in arrears? and I am living in Canada and have to pay online.

Forgot Password:

Kindly use the “Forgot Password” option available in the Login page to retrieve your password.

Steps To Paying Property Tax Online:

Step 1: Login

On the home page of the website jamaicatax.gov.jm click on the Login tab or the Client Login mini banner ad.

Step 2: Sign In

Enter username and password, if you already have an account to make payment. Otherwise create a new login to make payments.

Step 3: Pay Online

On the eServices page under Pay Taxes and Fees click on the option property tax.

Step 4: Paying Property Tax Online

Enter the valuation number, the strata lot number and select the fiscal year being paid. Please note that if the property is not a strata, enter 0, i.e. zero for strata number. Add to today’s total and proceed.

Step 5: Payment Information

Review the tax information to be paid, then enter the credit card data, making sure the information supplied is correct. Once the payment is completed you may email or print the statement of payment for your records.

I HAVE A PROPERTY IN TEMPLE HALL AND I’M THE ONLY PERSON BILLED FOR THE GOVERNMENT ROAD (RESERVE ROAD). I WENT TO TAX OFFICE IN CONSTANT SPRING. THEY SENT ME TO ARDENE ROAD & KSAC DOWN TOWN. THEY TOLD ME NOT TO PAY IT BUT THE BILL IS STILL COMING IN MY NAME. MY MANAGER PAID IT BY MISTAKE $5000.00. I AM VERY MUCH FED-UP OF THIS BILL AND WOULD LIKE THE MATTER TO BE SOLVED AND GET BACK MY MONEY.

VOL#104C4Y080452

I DON’T OWN THE ROAD AND MY PROPERTY DON’T TOUCH THE ROAD. I NEED SOME HELP.

I need to pay my land tax. But how do I set up my email?

I am trying to find out about a property in Jamaica and the tax.

I want to know about the due amount of the property tax for a studio house in Duhaney park. Please kindly intimate the exact amount so that I can make the payment.

I have recently created an account to pay my taxes online. I received the password to my mail. I have misplaced the password file. Can you please help me in retrieving my password?

Paid taxes were charged twice. How can I get refund?

I am trying to get information on property tax due. The required data is valuation number and strata number. I have only a register book volume and folio number. What should I do?

Trying to change my password, went through the process however the link that was sent to me when I accessed it indicated as invalid. I have been calling the phone number provided with no response. Really need some help as I am trying to pay my property tax.

My land tax for my property in Fort Charles, St Elizabeth went up 150%. No water available and to run electricity was paid for by the property owners. I would like to know when NWA plans to run water to this area because this area suffers from severe drought every year.

How do I know what is being required of me to pay is correct for a strata apartment?

Can I claim refund on tax?

Where can I get the valuation number?

How and where can I enter valuation number?

How much is the property taxes for 2017 valuation?

What is the tax for this year?

How can I find documents of tax paid from 1954 on my dad’s land?

I would like to know if the tax has paid on the land at Lilly field Bamboo St Ann.amt. 4/7/93 name:Adlin R. Brown

I made a payment yesterday on property at 1 randwick drive medowbrook Kingston 19. How soon will that payment be apply to that account?

I’M LIVING IN THE USA AND WOULD LIKE TO KNOW HOW TO PAY MY TAXES ONLINE?

How do I check my client TCC expired date on the non logon?

All I am seeing is just query tax.

I forgot my username and password. What can I do next?

I am trying to pay property tax and it is asking me for valuation number. Can’t I just put in the home address?

I would like to check the taxes by valuation #113010030713. How much is the due?

Making payment on this site is very difficult.

It is imperative that the site be reviewed and technical support provided for the glitches for consumers to get solutions.

I lived in an apartment. I have the strata number. However, to the check the status of my property tax arrears, the system requires a valuation number. I don’t have this number. What should I do?

What is the name of the person in the black river p.o. tax office St.Elizabeth Jamaica who can receive wired funds to pay property tax owing for landing?

I would like to pay for the property tax for my late father Alvin Cunningham who have passed away on the 28 of December 2013.

The property is located at lot 48 pitfour housing scheme Granville in the parish of St James. I would like to know if there is any outstanding payment owe on this property.

I have ben trying to Pay my tax on Line since yesterday, with no success as your system is not accepting my user name nor password. I have paid online for the past 5 years. I tried changing the password since your system has changed and has been unsuccessful. As I need to pay the taxes 2016-17 urgently, please advise ASAP. THANK YOU

I paid $3000 ja with my credit card. Will it show this amount in Canadian?

How can this be confirmed?

Amount intended to pay $3000.

I would like to pay my property tax but don’t have any info with me on the property also need to know the amount to pay.

Trying to get information online regarding property my deceased father left in Manchester. I know he didn’t sell it and I would like to check the tax record to see if anyone owns the land and is paying taxes on it. I do not have a Val# just my father’s name and the address in Manchester.

How do I obtain a valuation number for my piece of land?

Where do we get the valuation number?

I am having the same problem. I am not being able to pay property tax online. Have you worked it out?

I am trying to pay property tax for Estella Ellis In Port Antonio Val# 11604006066 but the browser will not open when placed on (add todays’s total)

Do you have a suggestion?

I am trying to pay property tax but is finding very difficult to log in to the website. Please advise, thank you.

I would like to pay outstanding tax for 43 Central Rd in Black River St Elizabeth Jamaica for my family there . The # for property is #16101002023 the name is under is Walter Brown. I would like to pay before 28 Feb by visa or money transfer. Could you give me information?

Cynthia Dixon, I would like to pay that tax on my granddaughter land at 20 Cling Cling avenue, Kingston 11, I have the title of land but I don’t know what number I applied T. 2488787 D.P. 2043 – register book volume 1054 Folio 412