FBR Federal Board of Revenue : Sales/ Excise/ Income Taxes Online Payment Pakistan

Name of the Organisation : Federal Board of Revenue (fbr.gov.pk)

Type of Facility : Tax Payment Online

Location : Islamabad

Country : Pakistan

| Want to comment on this post? Go to bottom of this page. |

|---|

Website : http://www.fbr.gov.pk/Default.aspx

What is FBR Tax Collection System?

Federal Board of Revenue (FBR) is in process of reforming its services and restructuring the Tax Collection System with major facilitation to its Tax Payers countrywide.

Related : Pakistan Federal Board of Revenue Application For NTN & Sales Tax Refund : www.statusin.org/1206.html

In this direction a major milestone is achieved by providing one point services to taxpayers through web based e-Portal https://web.archive.org/web/20210814091146/https://e.fbr.gov.pk/.

Pakistan Revenue Automation Pvt Limited [PRAL] is managing this e-Portal under the policies of FBR, Government of Pakistan. e-Payments of Taxes are one of the services co-hosted at this e-Portal. The service is jointly being carried out by PRAL and National Bank of Pakistan [NBP] under the CAP-II Project.

Taxpayer is issued a User ID, Password and PIN Code upon completion of successful enrollment process after due verifications and security checks of enrollment procedure. Taxpayer is required to submit all of his requests/filings/payments by entering his PIN Code for authorization purposes

How To Do Tax Payment Online?

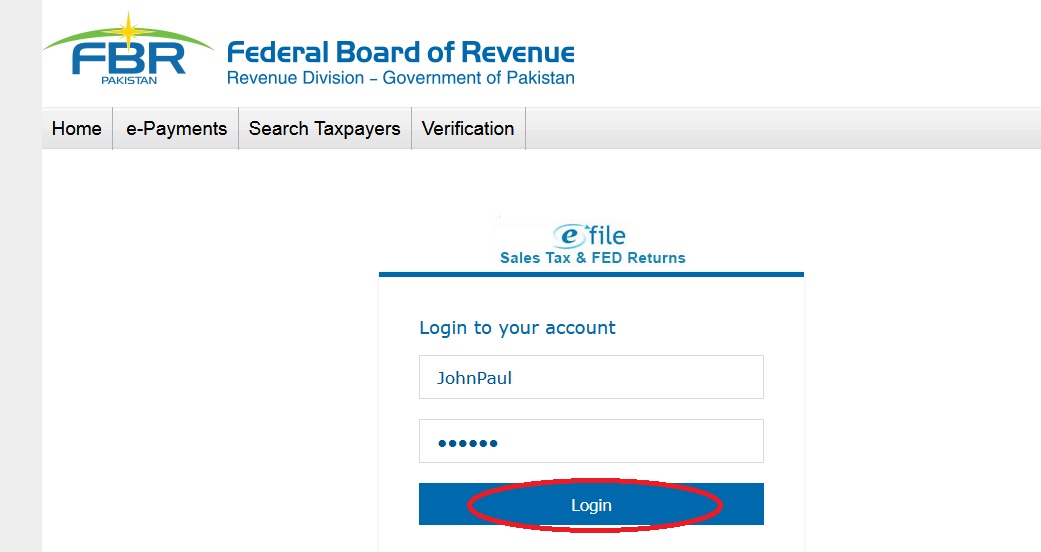

1 Taxpayer Login into system. Logon to https://web.archive.org/web/20210814091146/https://e.fbr.gov.pk/

2 Taxpayer Create Payment Slip Select the appropriate type of payment slip, and enter the data accordingly to create payment slip

3 Taxpayer Confirm Payment Slip Ensure that the data entered matches with physical challan

4 Taxpayer In case of mismatch In case of any mismatch, press the Back button and edit the payment

5 Taxpayer Payment Slip If payment created is correct press the confirm button, write PSID NO. on the payment challan

How To Print Sale Tax e-Payment Slip?

1. Login to the system i.e. https://web.archive.org/web/20210814091146/https://e.fbr.gov.pk/ by using the issued user id & password.

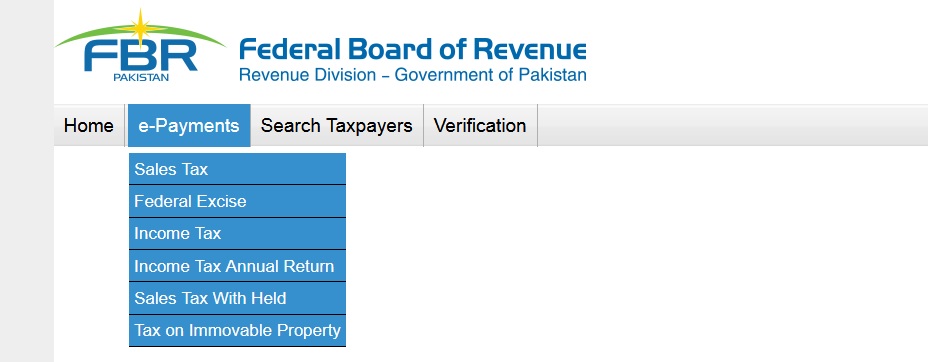

2. From the top menu, select e-Payments – Sale Tax.

3. On left control panel, from the drop down list select the payment month and payment year.

4. Under the “Create Payment Slip”, click on “Sales Tax”.

5. The system loads the create payment slip with the particulars of tax depositee and taxpayer.

6. Select the “Collectorate” from the “Taxpayer Particular Section”.

7. In section “Details of Payment”, enter the amount. System will automatically calculate and load the total.

8. After entering the amount, select the “Payment mode” from the section of “Particulars of Payment”. The payment mode can either be “Cash, Cheque, Pay Order and Direct Debit. The payment can be made with two different modes. e.g. in the combination of Cheque & Cash. Cheque & Pay Order, Cash & Pay Order.

9. Select the particular mode and provide the respective details. In case of “Cash Mode”, no other detail is required so click on “Create” Button.

10. If the mode selected is “Cheque”, give the respective details as well. From the drop down list of “Bank, City and Branch”, select the respective one.

11. If the amount given in section “Particulars of payment & the details of payment are not equal and we click on “Create” Button.. The error generates.

12. To enter another detail of payment particular, click on “Add” Button.. And provide the details.

13. Click on “Create” Button, to create the payment slip. After clicking the button, system asks for confirmation. If there is no change needed then click on “Confirm” Button or to edit the details click on “Back”Button..

14. When the payment particulars get confirmed the system loads the “e-Payment Slip” with the “PSID (Payment Slip ID)”. You can select the nearest NBP Branch to deposit the payments.

15. Click on “Print” Button, to get the payment Challan.

How To Print Federal Excise e-Payment Slip?

1. Login to the system by using the issued user id & password.

2. From the top menu, select e-Payments – Federal Excise

3. On left panel, select the “Payment year” and “Payment Month”. And from the “Create Payment Slip” section click on “Federal Excise”.

4. The system loads the Federal Excise Create Payment Slip, with the taxpayers & tax depositee particulars.

5. Select the “Collectorate” from the “Taxpayer Particular Section”.

6. In section “Details of Payment”, enter the amount. System will automatically calculate and load the total.

7. After entering the amount, select the “Payment mode” from the section of “Particulars of Payment”. The payment mode can either be “Cash, Cheque, Pay Order, Direct Debit, and Credit Card (Currently not functional). The payment can be made with two different modes. e.g. in the combination of Cheque & Cash. Cheque & Pay Order, Cash & Pay Order and so on.

8. Select the particular mode and provide the respective details. In case of “Cash Mode”, no other detail is required so click on “Create” Button.

9. If the mode selected is “Cheque”, give the respective details as well. From the drop down list of “Bank, City and Branch”, select the respective one.

10. If the amount given in section “Particulars of payment & the details of payment are not equal and we click on “Create” Button. The error generates.

11. To enter another detail of payment particular, click on “Add Button”… And provide the details.

12. Click on “Create” Button, to create the payment slip. After clicking the button, system asks for confirmation. If there is no change needed then click on “Confirm” Button or to edit the details click on “Back”Button..

13. When the payment particulars get confirmed the system loads the “e-Payment Slip” with the “PSID (Payment Slip ID)”. You can select the nearest NBP Branch to deposit the payments.

14. Click on “Print” Button, to get the payment Challan.

How To Print Direct Taxes e-Payment Slip?

1. Login to the system i.e. https://web.archive.org/web/20210814091146/https://e.fbr.gov.pk/ by using the issued user id & password

2. From the top menu, select “e-Payments – Direct Taxes”.

3. At the left control panel, select the “Payment Year” and “Payment Month” from the drop down list.

4. At “Create Payment Slip” section, click on “Direct Taxes”.

5. The system loads the e-Payment direct taxes creation page with the tax depositee particulars.

6. From the “Direct Taxes Payment” section, select the “Nature of Tax Payment”.

7. The Nature of Tax Payment defined in eFBR Portal are :

Current Demand.

With Return.

Advance Payment

Arrear Demand.

Deduction at Source.

Misc. /Others.

CVT on Purchase of Property.

8. Select the “Salary Month”.

9. Select the “Tax Office”.

Creating e-Payment Slip of “Deduction at Source”

1. If nature of payment selected is “Deduction at Source”, there are two options available to enter the data,

a. Attach File b. Online Entry

2. You can also attach file for payments, from its section by clicking on “Attach File” button.

3. By clicking on “Attach File” the system loads the page to upload the file to get attached.

4. The sample file in excel format is also available for help to create the attach file.

5. The file can be downloaded by simply clicking on the link “Download Sample File”.

6. Create the file by seeing the sample file, browse it & then get it attach.

7. Click on “Import” button to upload the attached file.

8. Click on “Back”button to move back to the e-Payment Direct Taxes Page.

9. To enter the data online.

10. In “Taxpayers Details” section, add the asked details.

11. From the “Payment Section” drop down list, select one.

12. Enter the Taxpayers NTN, if the NTN is present in system, it will automatically loads the remaining details. Else enter the respective detail too.

13. For some tax payment nature selection, it loads the taxpayers detail as well.

14. When enter the Taxable Amount and Tax Rate, it will calculate the Tax Amount automatically.

15. Click on “Add” button.

16. The tabular grid appeared, showing the record added before and the total amount of tax to be paid.

17. “Payment Particular” section, add the payment mode & its details.

18. To create the e-payment slip, click on “Create” button.

19. Confirm it by clicking on “Confirm” button.

20. Select the nearest NBP branch and “Print” Challan.

How to file for tax payed on buying property like CVT and stamp duty?

Please follow the above procedure to pay your tax online.