Submit a TCC Application Online Jamaica : jamaicatax.gov.jm

Organization : Tax Administration Jamaica

Facility : Submit a TCC Application Online – Tax Compliance Certificate

Country : Jamaica

Website : https://www.jamaicatax.gov.jm/web/guest/home

Terms & Conditions : https://www.statusin.org/uploads/30064-TCC-Appln.pdf

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Submit Jamaica TCC Application Online?

Effective December 7th 2015 individuals and organisations that are registered for eServices with Tax Administration Jamaica will have access to making these requests online using the new eService facility of Tax Administration Jamaica (TAJ).

Related / Similar Facility : Jamaica Tax Zero Rating Request Online

To access this service, the Customer will be required to complete two main steps :

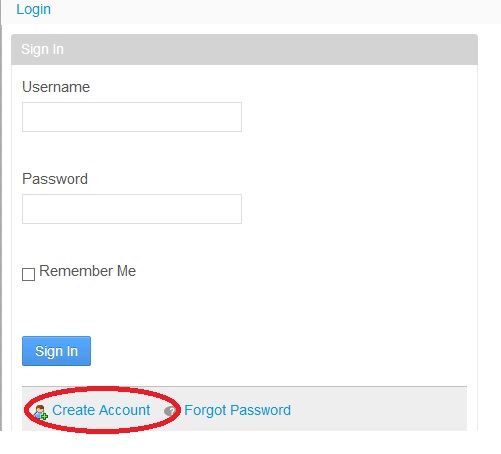

1. Visit TAJ’s Enterprise Portal and create a new username and password. This can be done by clicking the “Client Login” banner or “Login” link followed by clicking the “Create Account” link.

2. Register for eServices by downloading and completing the Application for eServices Account Form or applying for an e-Services Account online.

NB. To apply for an e-Services Account online, visit the TAJ Website and log in the TAJ Web Portal, select the “Do Business” tab on the TAJ homepage, then select the “Manage My Account” hyperlink.

Select the hyperlink “Apply for an e-Services Account” from the e-Services home page. A default “Instructions” page giving basic information about the service, what will be needed, and what to expect at the end of the process is displayed. NB. We recommend that you use Google Chrome or Mozilla Firefox web browsers.

Once registered, you can proceed to apply for Tax Compliance Certificate as follows :

1. Log in to the Enterprise portal

2. Select “Manage My e-Services Account”

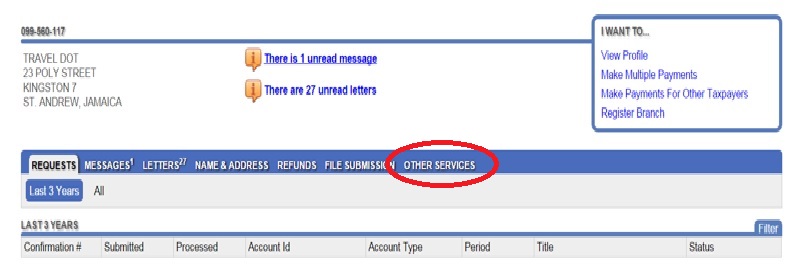

3. Select “Other Services””

4. Select “Apply for Tax Compliance Certificate”.

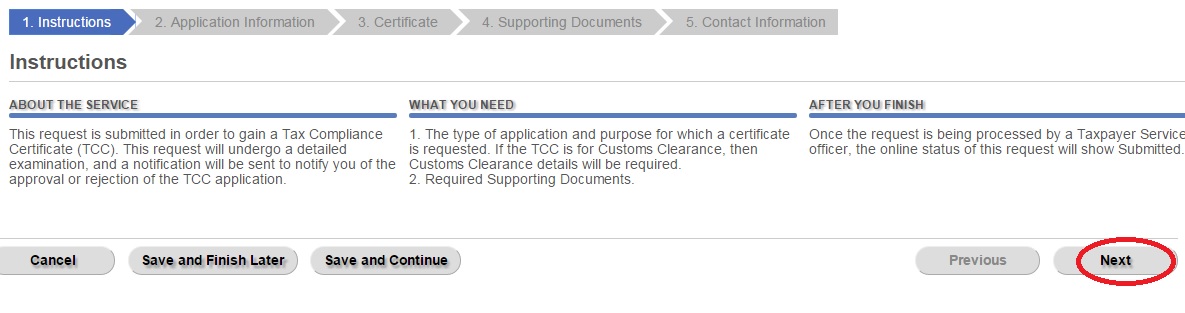

5. Select “Next” after reading instructions/information.

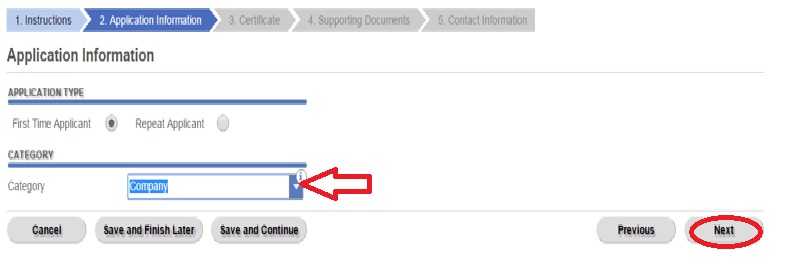

6. Select the appropriate item to indicate whether or not the TCC is for a First Time Applicant or Repeat Applicant. Also select the category in which the applicant falls then select next. NB. All first time applicants are required to visit TAJ for an interview.

7. Select the appropriate reason from the “Certificate is required for” list. Add additional information that you think may be pertinent to this application in the field for “Additional Information”.

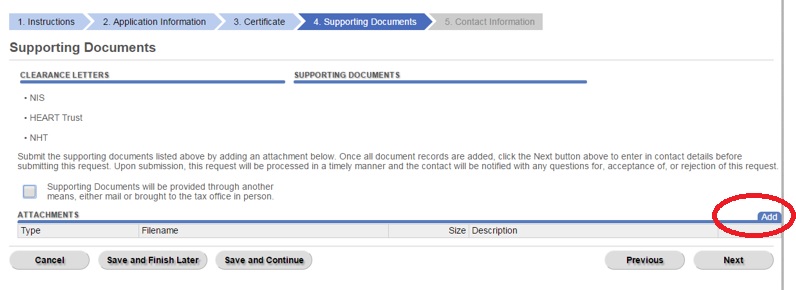

8. Add copies of the applicable Supporting Documents and Clearance Letters if applicable. Select add

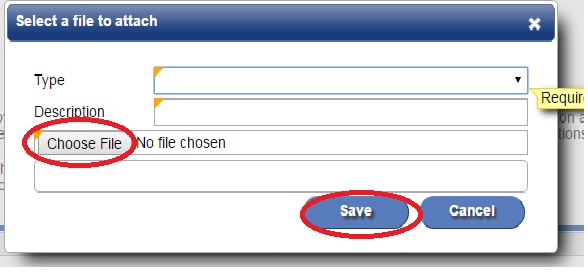

9. Select type of document -> add description -> select file for upload from your computer -> Select “Save” to complete upload of file

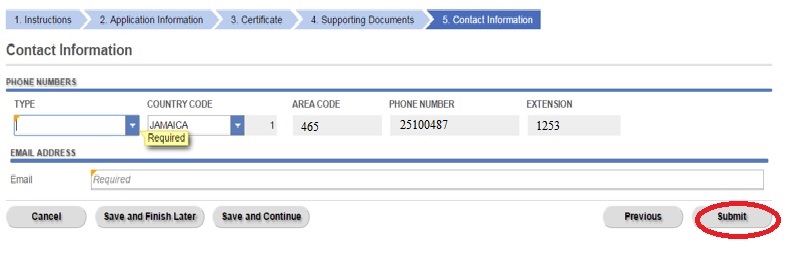

10. Enter contact telephone and email address then select submit.

11. Read information displayed, then select “OK” to complete submission.

The Tax Compliance request will then be processed by TAJ. An email will be sent to email address associated to the e-service login that submitted the request as soon as processing is complete.

The applicant may be required to visit their nearest Tax Office with original supporting documents or for an interview before the TCC process can be completed.

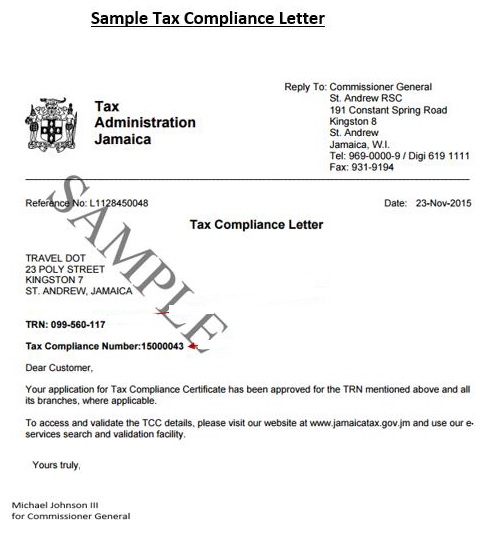

Sample Tax Compliance Letter

However, they will be contacted if this is required. A “Tax Compliance Letter” or “Tax Compliance Rejection Letter” will be sent to the customer’s “TAJ eServices Account”.

Im just wondering if this is what the certificate looks like that you will be presenting when a tcc is required? i presented the tax compliance letter/notif and was told that is not the appropriate document.

I need to apply for tax returns.

I need to apply for my NHT refund, how do I go for it?

Please tell, how do I access NHT refund application form.